Impact of Debt & Interest Payments on the Global & Malaysian Economy

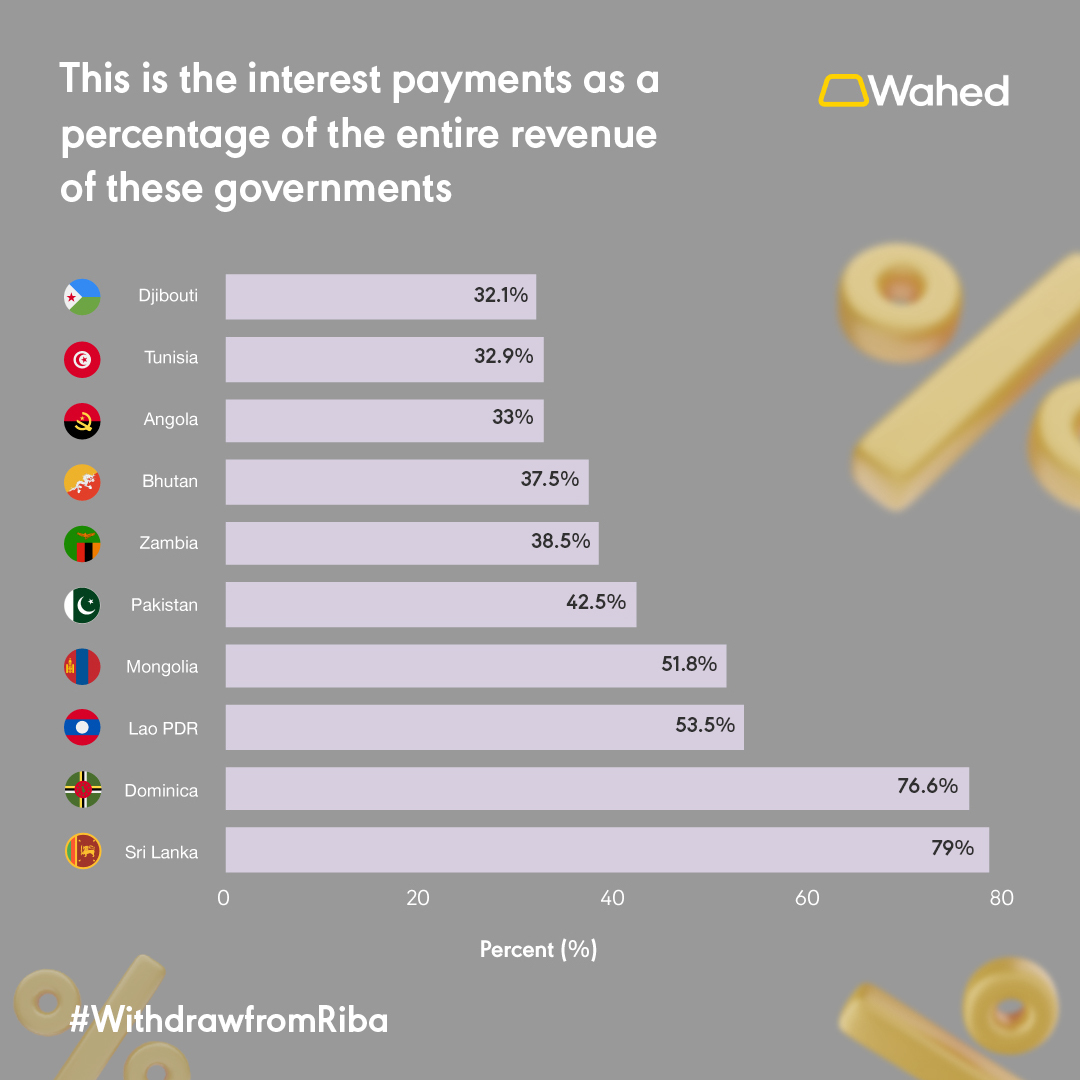

Interest repayments don’t just weigh heavily on poor and middle-class families, they also crush corporations and nations. In 2023, the Institute of International Finance reported that global debt has reached $313 trillion. Countries like Pakistan and Sri Lanka are prime examples of how debt, fueled by interest payments, can bring national economies to the brink of collapse.

Impact on nations

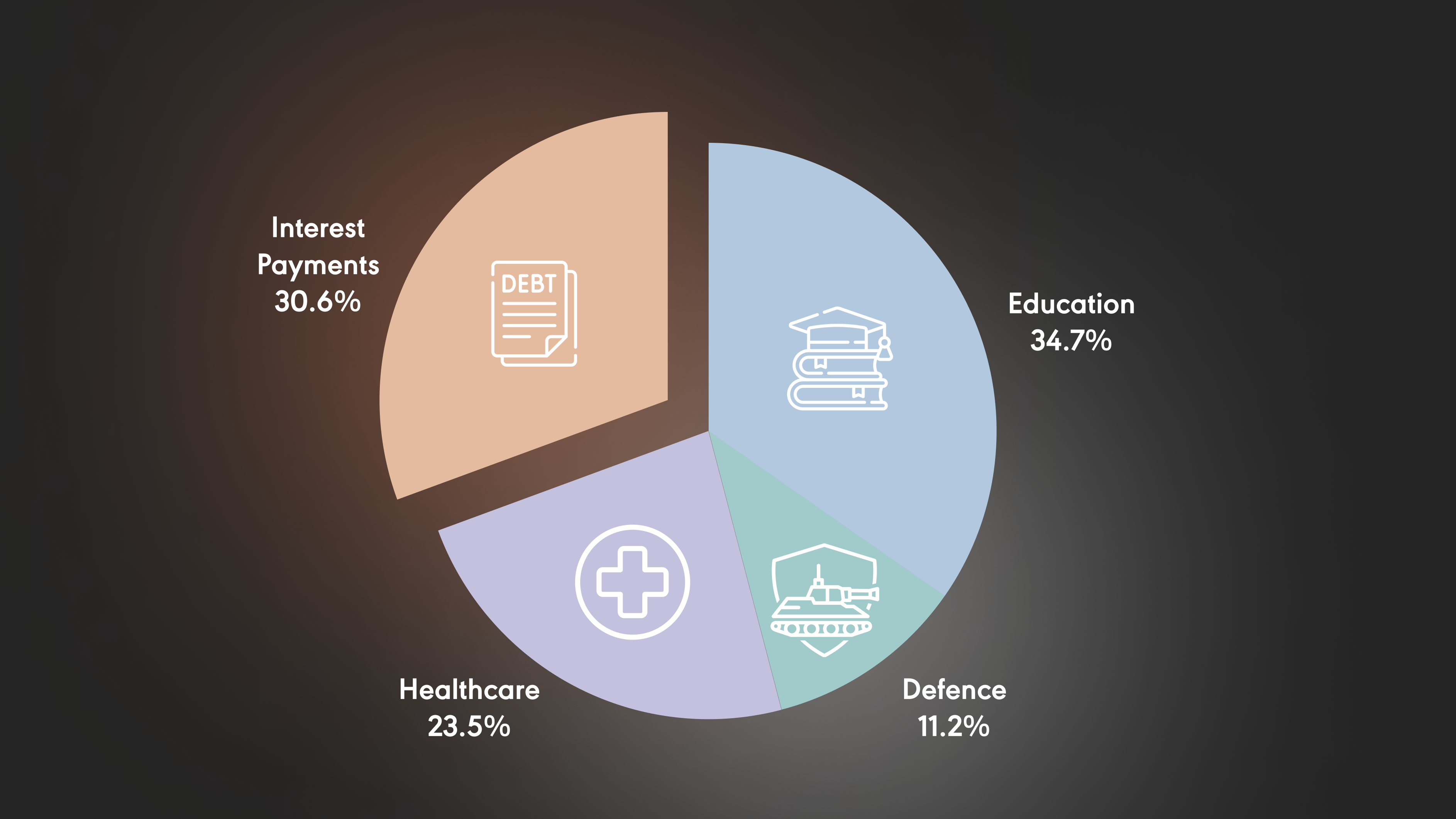

Developing countries are particularly vulnerable to the repercussions of high debt and interest payments. In 2022, these nations spent a record $443.5 billion servicing their external public debt, a significant increase that diverts funds from critical sectors like health and education. Furthermore, 54 developing countries allocate more than 10% of their revenues to interest payments, with 48 spending more on interest than on education or health.

Pakistan has to spend 62% of its fiscal revenues such as taxes, on its interest payments. Sri Lanka reported that they would spend 75% of their revenue on just debt payments. These concerning statistic limits these nations’ ability to invest productively, thereby impeding economic growth and social development.

Malaysia is not left out too

Malaysia’s national debt has been steadily increasing over the years. As of 2023, the country’s total debt stood at RM1.5 trillion, equivalent to about 65.6% of its Gross Domestic Product (GDP). This debt is a combination of domestic and external borrowings, both of which come with interest obligations that need to be serviced regularly. The increasing debt-to-GDP ratio signals that a growing portion of the country’s resources is being directed toward managing debt.

This year, Malaysia is projected to spend approximately RM46.1 billion on debt servicing, which accounts for around 16% of the government's total revenue. As the nation's debt continues to increase, this figure is expected to rise.

How does the Government go into debt?

Every year, the Malaysian government announces the national budget, and one of the areas they would allocate funds to is debt repayments. A governments revenue, or balance of payments can be simplified as:

Balance of trade = Government income (Assets) - Government expenditure (liabilities)

Most of the time, the government's income is insufficient to cover necessary expenditures or make long-term investments for development, such as building public schools, expanding public transport, and more. The government must continue spending to support the nation’s growth, whether through subsidies or by providing essential public services. Without this spending, the country risks coming to a halt.

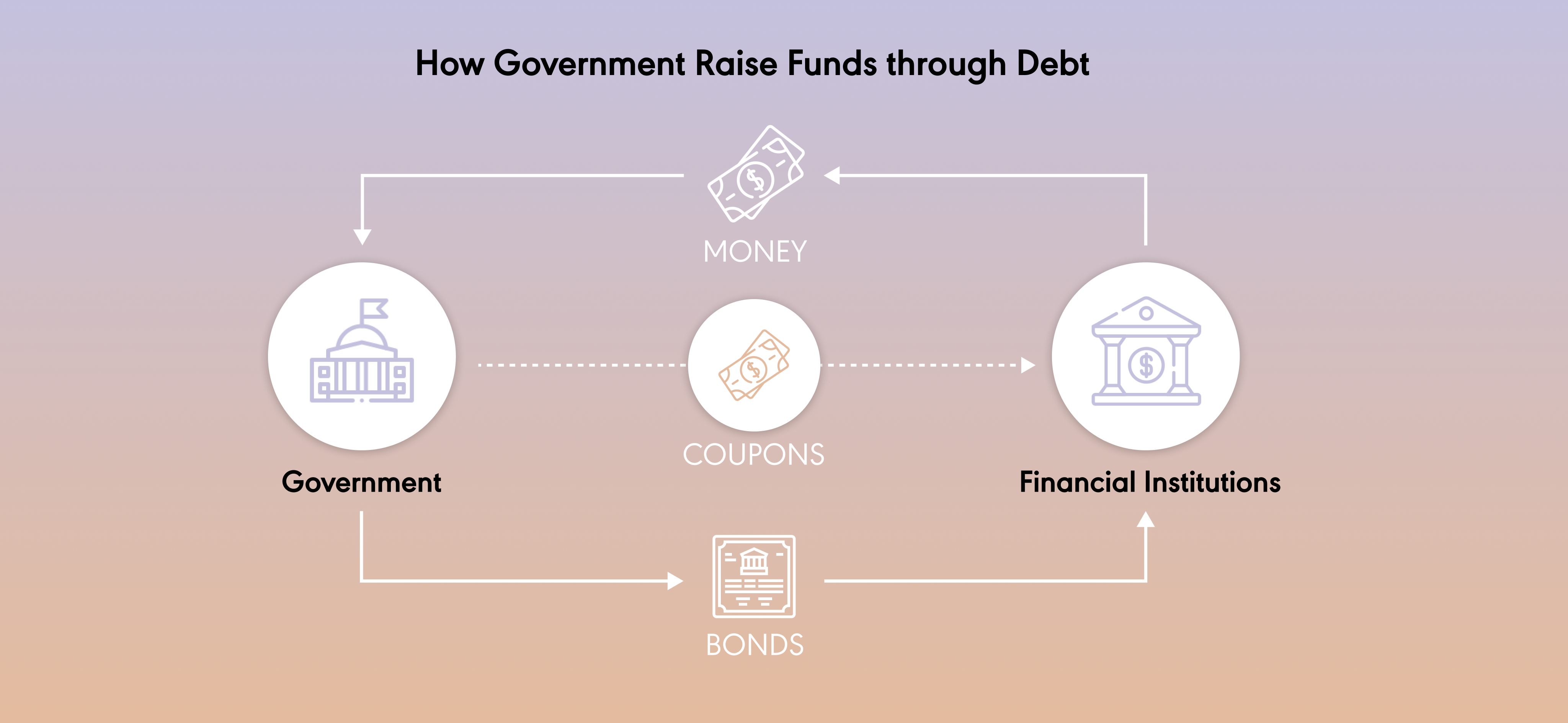

To make up for the shortfall, the government raises money by borrowing from local and international financial institutions through the issuance of bonds. Bonds are therefore like loans that the government takes; with the promise to pay the bondholders back the full amount after a set time with interest. This repayment occurs in two forms:

- Coupon payments: Regular interest payments made to bondholders throughout the loan period.

- Principal repayment: The full amount borrowed, which is returned to the bondholder upon maturity of the bond.

This system allows governments to borrow large sums of money, but it also means they accumulate debt that needs to be repaid, often with significant interest, contributing to the overall national debt.

The global debt is an aggregate of debts owed by governments, financial institutions, corporations, and even individuals. Debt is often seen as a catalyst for growth and development, but the cost of servicing this debt frequently limits future progress. When combined with interest and inflation rates, it can create a vicious cycle of borrowing that is difficult to escape.

The scary effects of debt

- Stagnation of Economic Growth: With governments, corporations, and individuals all focused on repaying debt, the ability to invest in future growth is limited. This results in economic stagnation, where there is little progress despite increasing levels of borrowing.

- Widening Inequality: The burden of debt servicing falls disproportionately on individuals, particularly low-income households. As governments reduce social spending to service debt, those who rely on public services are hit the hardest, deepening inequality.

- Increased Borrowing: As debt servicing limits growth, the need for additional borrowing increases. Governments and corporations take on more debt to fund essential services or expansion, further deepening the cycle of indebtedness.

What can you do though?

Although the debt as we explained above is at the national level, the mechanics is the same and affects ordinary people like you too. Just by partially withdrawing from this vicious cycle of debt and interest, you're already making a significant impact. As Mahatma Gandhi once said, "Be the change you wish to see in the world." If one person makes the change, it can inspire others, creating a ripple effect that encourages more people to step away from the burden of riba.

At Wahed, we're proud to have over 400,000 investors worldwide who have chosen to grow their wealth free from interest and riba. Join us in making the world a more just and equitable for all.

Risk Warning: Equity investments are not readily realisable and involve risks, including loss of capital, illiquidity, lack of dividends and dilution, and it should be done only as part of a diversified portfolio. Investments of this type are only for investors who understand these risks. You will only be able to invest in the company once you have met our conditions for becoming a registered member.

Please visit www.wahed.com/uk/ventures/risk for our full risk warning.

Risk Warning: As with any investment, a Wahed Invest Ltd investment puts your money at risk, as the value of your investment can go down as well as up. The tax treatment of your investment will depend on your individual circumstances and may change in the future. If you are unsure about whether investing is right for you, please seek expert financial advice.

Please visit www.wahed.com for our full terms and conditions

Maydan Capital Limited, trading as WahedX, is registered in England and Wales (Company No. 13451691), registered office: 87-89 Baker Street, London, W1U 6RJ, UK. Maydan Capital Ltd (FRN: 963613) is an appointed representative of Wahed Invest Ltd (FRN: 833225), an authorised and regulated firm by the Financial Conduct Authority.Wahed Invest Ltd. is registered in England and Wales (Company No. 10829012), registered office: 87-89 Baker Street, London, W1U 6RJ, UK and is authorised and regulated by the Financial Conduct Authority: FRN 833225.

Subscribe For More Islamic Finance Content

As with any investment, a Wahed Invest Ltd investment puts your money at risk, as the value of your investment can go down as well as up. The tax treatment of your investment will depend on your individual circumstances and may change in the future. If you are unsure about whether investing is right for you, please seek expert financial advice.

Wahed Invest LLC (Wahed) is a US Securities and Exchange Commission (SEC) registered investment advisor. Wahed Invest provides brokerage services to its clients through its brokerage partner Apex Clearing Corporation, a member of NYSE - FINRA - SIPC and regulated by the SEC and the Commodity Futures Trading Commission. Registration does not imply a certain level of skill or training. Wahed does not intend to offer or solicit anyone to buy or sell securities in jurisdictions where Wahed is not registered or a region where an investment practice like this would be contrary to the laws or regulations. Any returns generated in the past do not guarantee future returns. All securities involve some risk and may result in loss. Any performance displayed in the advertisements or graphics on this site are for illustrative performances only.

Disclaimer: Wahed Technologies Sdn Bhd ("Wahed") is a Digital Investment Manager (DIM) licensee issued by Securities Commission Malaysia (eCMSL/ A0359/2019). It is part of Wahed Inc. Wahed is authorized to conduct a fund management business that incorporates innovative technologies into automated portfolio management services offered to clients under a license issued pursuant to Schedule 2 of the Capital Markets Services Act 2007. All investments involve risks, including the possibility of losing the money you invest, and the track record does not guarantee future performance. The history of returns, expected returns, and probability projections is provided for informational and illustrative purposes, and may not reflect actual future performance. Wahed is not responsible for liability for your trading and investment decisions. It should not be assumed that the methods, techniques, or indicators presented in this product will be profitable, or will not result in losses. The previous results of any trading system published by Wahed, through the Website or otherwise, do not indicate future returns by that system, and do not indicate future returns that will be realized by you.

Wahed Invest Limited is regulated by ADGM’s Financial Services Regulatory Authority (“FSRA”) as an Islamic Financial Business with Financial Services Permission for Shari’a Compliant Regulated Activities of Managing Assets and Arranging Custody [Financial Permission No. 220065]. Our ADGM Registered No. is 000004971.

Wahed assumes no obligation to provide notifications of changes in any factors that could affect the information provided. This information should not be relied upon by the reader as research or investment advice regarding any issuer or security in particular. Any strategies discussed are strictly for illustrative and educational purposes and should not be construed as a recommendation to purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. Furthermore, the information presented may not take into consideration commissions, tax implications, or other transactional costs, which may significantly affect the economic consequences of a given strategy or investment decision. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance.

There is no guarantee that any investment strategy will work under all market conditions or is suitable for all investors. Each investor should evaluate their ability to invest long term, especially during periods of downturn in the market. Investors should not substitute these materials for professional services and should seek advice from an independent advisor before acting on any information presented. Any links to third-party websites are provided strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided at these websites nor do we endorse the content and information contained on those sites. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the third-party websites.