How Inflation Is Destroying Your Savings

Inflation.

A word we’ve been hearing about so often to describe the gloomy economy we seem to always be in.

Though it's often used to describe an entire country's economic situation, it is always worth thinking about how it affects us all individually, and more importantly, what it means for the money we’re putting into our savings accounts.

So.. what actually is Inflation?

Inflation is the rate at which prices (of goods and services) in an economy increase over time. As inflation rises, the purchasing power of money falls because more money is needed to buy the same goods.

Economists use measures such as the Consumer Price Index (CPI) to track the level of inflation. These indexes work by tracking the average change in prices over time that consumers pay for a representative basket of goods and services and this figure is what is reported in the news.

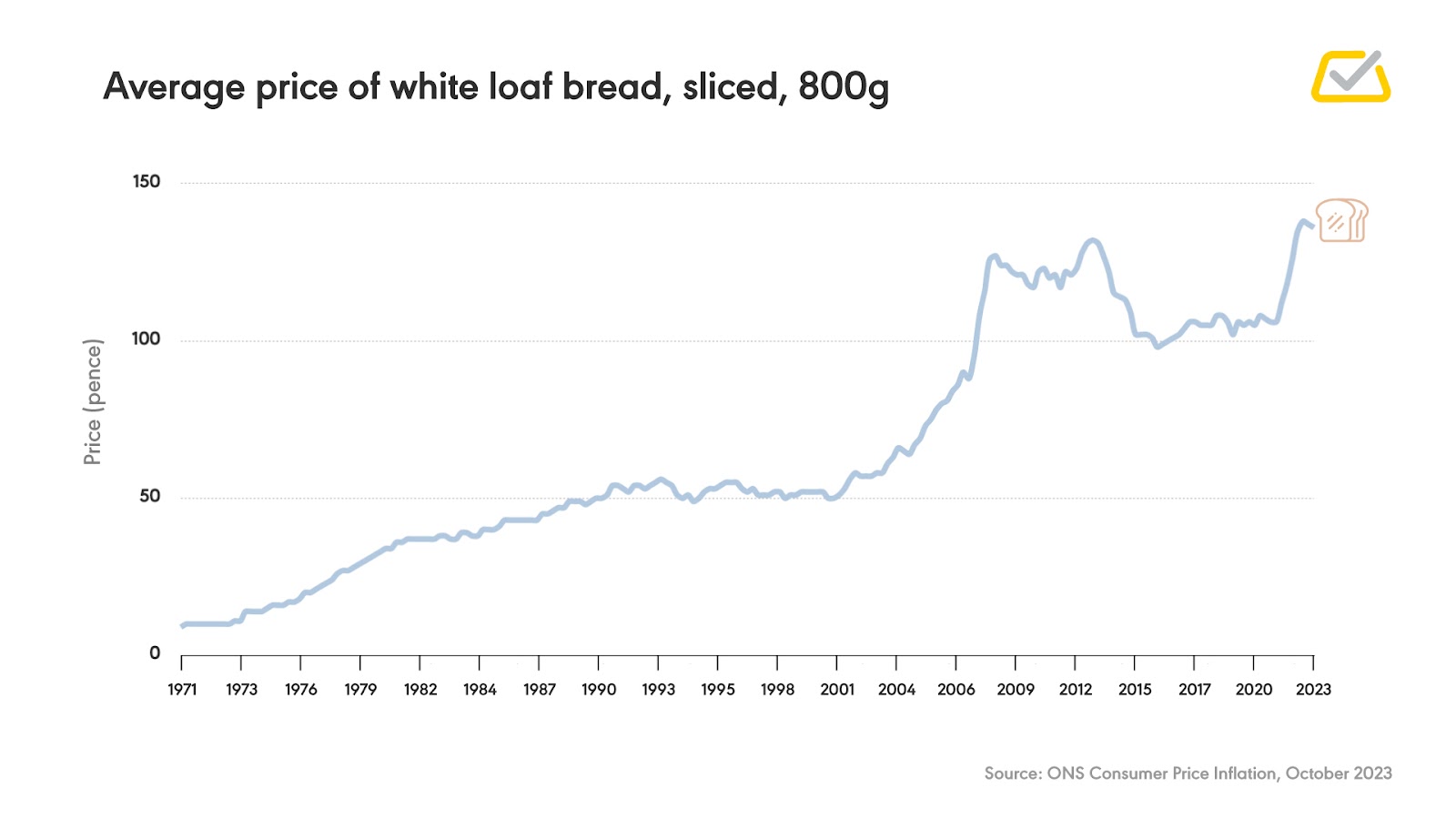

To illustrate this, let’s look at a couple of the items that make up this basket. First up is a slice of 800g white loaf bread which forms part of the UK CPI.

Since 1971, the average price has gone from 9p to £1.36, which is an increase of 1411%!

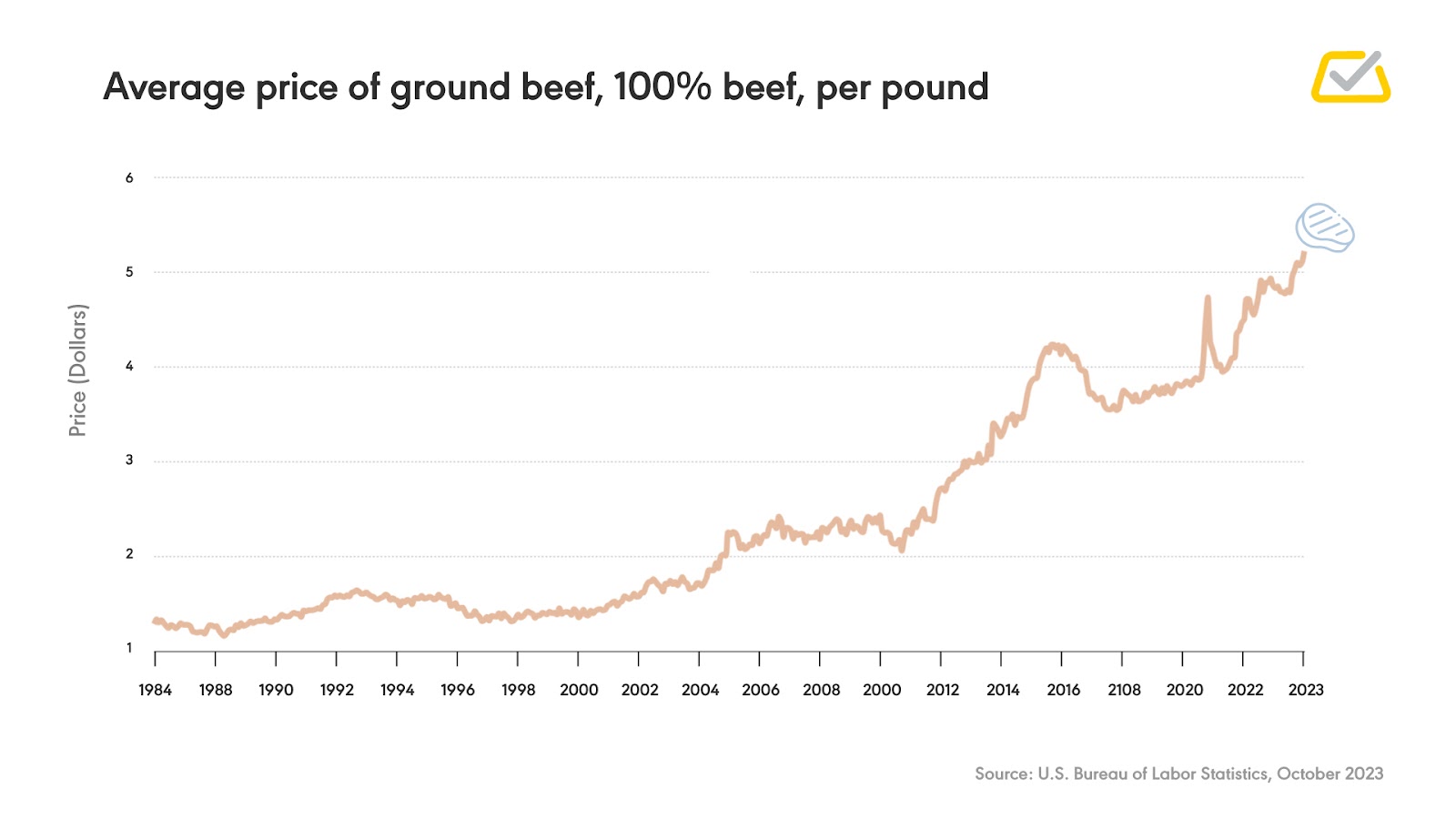

Let’s take a look at an example from the US index and look at the average price of a pound of ground beef.

In 1984, the price was $1.29. This has since risen to an average price of $5.23 in October 2023, an increase of 315%.

As you can see, the inflation rate will vary based on the item and location. Of course, the average inflation rate based on a representative basket of will approximate a general rise in the price of goods and services. However, your personal inflation rate will be driven by your individual spending habits.

The point is clear though. The fuel for your car, the energy for your home, your weekly grocery shop, they’ve all increased in the last few years and it means that the money we have becomes worth less and less each year (because you can buy fewer and fewer things with it).

Well..how does it affect me?

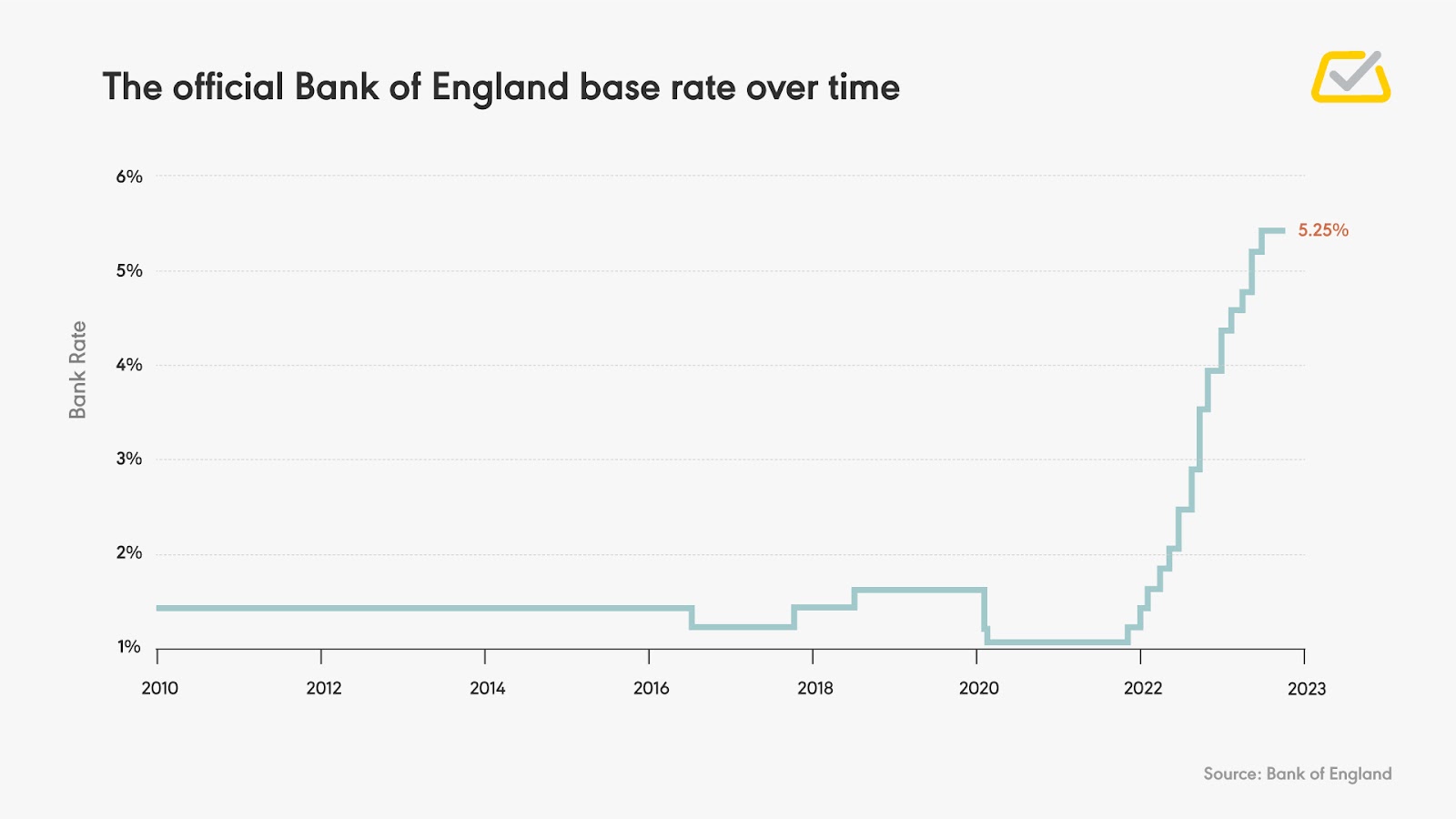

Most people store their money in the bank in a savings account that likely pays interest. This interest rate is governed by the base rate set by the central bank of a country. In the UK, it’s the Bank of England.

They set a base rate that influences all the other interest rates in the country. Here’s how the Bank of England base rate has changed since 2010.

As you can see over the past 2 years, the interest rate has been ramped up as central banks attempt to tackle soaring inflation. One of the consequences of this is that interest rates are as high as they have been for a while.

In December 2023, the top savings rate offered is 5.4% in the US and 5.65% in the UK. Whilst that seems rosy, this still does not take into account the rate of inflation.

In September 2023 for instance, the inflation rate in the UK was 6.7%. Assuming this was the average rate of inflation for the entire year, having your money in an account paying you 5% interest means in REAL terms (i.e. adjusting the power of your money for inflation) your money is less powerful than it was at the start of the year, despite you making 5%.

Going back to our white bread example, if you had £100 at the start of 2022, this would be enough money to buy 93 loaves of white bread. If you saved that £100 in 2022 at an interest rate of 5%, you would have £105 at the start of 2023 but this would only buy you 72 loaves of bread. Of course, it’s very unlikely that anyone would purchase this many loaves of bread but it illustrates the problem perfectly!

Even though you saved the money, you are still majorly out of pocket as the purchasing power of your money has fallen.

The problem with interest

This issue becomes even bigger for Muslims. We know this because in the Qur’an it is written:

“O believers! Fear Allah, and give up outstanding interest if you are ˹true˺ believers.” (2:278, The Clear Quran translation)

This is enough for us to know that interest is completely prohibited and so we should in the first instance not even be putting our money in these types of accounts and if we are, we should not be benefitting from the interest at all.

This brings us to the concept of purification in Islamic finance. Purification is the cleansing process that requires any income that might have been generated from unlawful activities according to Islamic principles to be given to charity. For more, take a look at our Shariah page.

This means in practice, any interest income received should be donated to purify our money. Of course, the consequence of this is that we feel the effect of inflation even harder.

So what can you do about this?

It is not all doom and gloom, and that’s where we come in.

‘’But Allah has permitted trading and forbidden interest’’ (2:275, The Clear Quran translation)

Just as interest is actively prohibited in Islamic Finance, trade is actively promoted and encouraged. So investing our money into the economy is a real option for us to grow our wealth and this is exactly how Wahed is helping over 300,000 customers just like you grow their wealth in a way that is in line with your faith and values.

We do this by investing your money into different investments that are matched to you, and that you feel comfortable with.

And we know that investing your money is not just about making sure it is done in a Shariah-compliant way, but also done in a way that actually grows your wealth and helps you to achieve the things you want in life. And that is why we are focused on investing your money in a way that gives you the performance you need, without compromise.

Our focus is to give you performance, without compromise. But don’t just take our word for it! Take a look at the below chart where we’ve added our actual performance for the past 5 years across a range of UK portfolios and benchmarked them against the inflation rate.

As you can see this perfectly underscores why investing is crucial for your financial future as the real rate of return for investment accounts is generally higher than savings accounts (which as we mentioned earlier don’t even keep pace with inflation).

To start your journey to halal¹ investing and make your money work for you, sign up here.

1. The term 'Halal' denotes that it is permitted and follows Islamic law

Risk Warning: Equity investments are not readily realisable and involve risks, including loss of capital, illiquidity, lack of dividends and dilution, and it should be done only as part of a diversified portfolio. Investments of this type are only for investors who understand these risks. You will only be able to invest in the company once you have met our conditions for becoming a registered member.

Please visit www.wahed.com/uk/ventures/risk for our full risk warning.

Risk Warning: As with any investment, a Wahed Invest Ltd investment puts your money at risk, as the value of your investment can go down as well as up. The tax treatment of your investment will depend on your individual circumstances and may change in the future. If you are unsure about whether investing is right for you, please seek expert financial advice.

Please visit www.wahed.com for our full terms and conditions

Maydan Capital Limited, trading as WahedX, is registered in England and Wales (Company No. 13451691), registered office: 87-89 Baker Street, London, W1U 6RJ, UK. Maydan Capital Ltd (FRN: 963613) is an appointed representative of Wahed Invest Ltd (FRN: 833225), an authorised and regulated firm by the Financial Conduct Authority.Wahed Invest Ltd. is registered in England and Wales (Company No. 10829012), registered office: 87-89 Baker Street, London, W1U 6RJ, UK and is authorised and regulated by the Financial Conduct Authority: FRN 833225.

Subscribe For More Islamic Finance Content

As with any investment, a Wahed Invest Ltd investment puts your money at risk, as the value of your investment can go down as well as up. The tax treatment of your investment will depend on your individual circumstances and may change in the future. If you are unsure about whether investing is right for you, please seek expert financial advice.

Wahed Invest LLC (Wahed) is a US Securities and Exchange Commission (SEC) registered investment advisor. Wahed Invest provides brokerage services to its clients through its brokerage partner Apex Clearing Corporation, a member of NYSE - FINRA - SIPC and regulated by the SEC and the Commodity Futures Trading Commission. Registration does not imply a certain level of skill or training. Wahed does not intend to offer or solicit anyone to buy or sell securities in jurisdictions where Wahed is not registered or a region where an investment practice like this would be contrary to the laws or regulations. Any returns generated in the past do not guarantee future returns. All securities involve some risk and may result in loss. Any performance displayed in the advertisements or graphics on this site are for illustrative performances only.

Disclaimer: Wahed Technologies Sdn Bhd ("Wahed") is a Digital Investment Manager (DIM) licensee issued by Securities Commission Malaysia (eCMSL/ A0359/2019). It is part of Wahed Inc. Wahed is authorized to conduct a fund management business that incorporates innovative technologies into automated portfolio management services offered to clients under a license issued pursuant to Schedule 2 of the Capital Markets Services Act 2007. All investments involve risks, including the possibility of losing the money you invest, and the track record does not guarantee future performance. The history of returns, expected returns, and probability projections is provided for informational and illustrative purposes, and may not reflect actual future performance. Wahed is not responsible for liability for your trading and investment decisions. It should not be assumed that the methods, techniques, or indicators presented in this product will be profitable, or will not result in losses. The previous results of any trading system published by Wahed, through the Website or otherwise, do not indicate future returns by that system, and do not indicate future returns that will be realized by you.

Wahed Invest Limited is regulated by ADGM’s Financial Services Regulatory Authority (“FSRA”) as an Islamic Financial Business with Financial Services Permission for Shari’a Compliant Regulated Activities of Managing Assets and Arranging Custody [Financial Permission No. 220065]. Our ADGM Registered No. is 000004971.

Wahed assumes no obligation to provide notifications of changes in any factors that could affect the information provided. This information should not be relied upon by the reader as research or investment advice regarding any issuer or security in particular. Any strategies discussed are strictly for illustrative and educational purposes and should not be construed as a recommendation to purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. Furthermore, the information presented may not take into consideration commissions, tax implications, or other transactional costs, which may significantly affect the economic consequences of a given strategy or investment decision. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance.

There is no guarantee that any investment strategy will work under all market conditions or is suitable for all investors. Each investor should evaluate their ability to invest long term, especially during periods of downturn in the market. Investors should not substitute these materials for professional services and should seek advice from an independent advisor before acting on any information presented. Any links to third-party websites are provided strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided at these websites nor do we endorse the content and information contained on those sites. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the third-party websites.