8 Reasons Why You Should Invest in Real Estate with Wahed

Have you ever considered investing in properties but felt discouraged by huge down payments, complex legal work and stressful tenants?

Or perhaps it was the fear of getting trapped in riba-based debt that kept you away?

Imagine if these obstacles didn't exist, and you could effortlessly own properties in London or Manchester and beyond without paying thousands of pounds in down payments or dealing with the complicated responsibilities of being a landlord.

Sounds too good to be true, right? Well, it isn’t!

At Wahed, we make investing in real estate as easy as 123. We’re revolutionising the way you invest in properties, making it accessible for everyone. Here are the top 8 reasons why you should think about investing in real estate with us:

1. Strictly Shariah-compliant

In traditional real estate investing, you often need to take out a mortgage to buy a property. Any sort of conventional loan or leverage involves paying interest (also known as riba), which is explicitly prohibited by Islamic law.

We adhere to a strict no-debt policy, making sure that all our properties are bought outright with cash, without any borrowing. This means that your investments with us are always Shariah-compliant.

Our dedication to maintaining Shariah compliance is upheld by a panel of the Shariah Review Bureau (SRB), a body of scholars who rigorously review and approve all our investment practices. As part of this commitment, we ensure that no property is listed in our app without prior approval by the SRB.

You can learn more about our commitment to Shariah here.

2. We manage everything for you

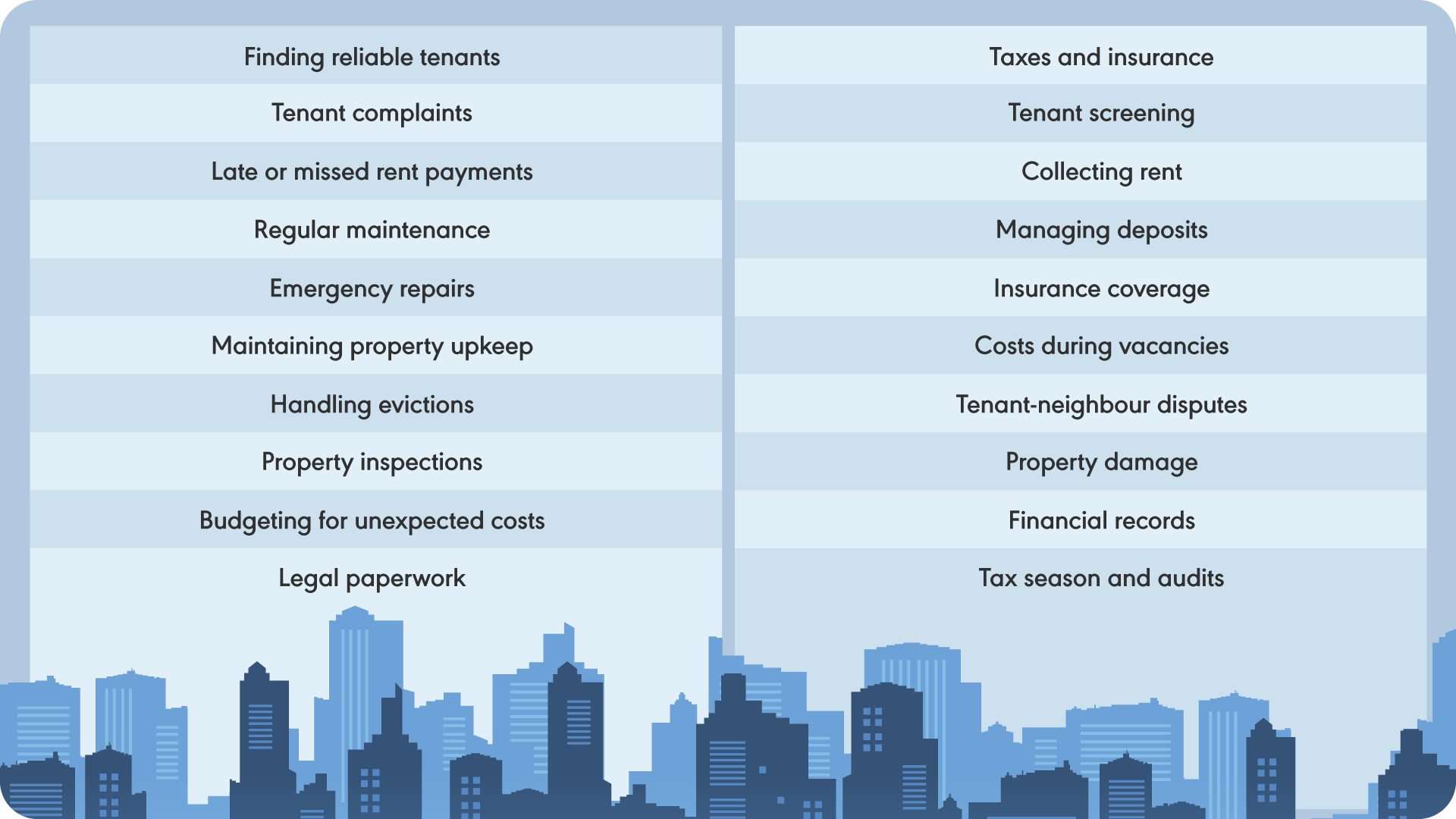

We let you invest in properties without the hassles of being a landlord. Wahed handles everything from vetting and selecting tenants to managing day-to-day concerns and even the final sale of the property.

Here’s a short list of things you won’t ever have to deal with:

With us, you get all the benefits of owning a property without any of the headaches. This lets you focus on other aspects of life while we take care of your investment 24/7.

3. Investing with us is extremely simple

As a beginner, starting out in property investing is a time-consuming and complex process that requires a deep understanding of locations, legal procedures and financial strategies.

Wahed makes real estate investing very easy and straightforward. All you need to do is pick a property, review the investment materials, choose how much you want to invest, and then sit back and watch how your investment performs.

.png)

4. You can start investing with just £500

Buying conventional residential properties requires a substantial amount of capital. Let’s break down the estimated costs to buy a £350,000 property:

- 20% down payment: £70,000

- Conveyancer fees: £2,000

- Mortgage booking fee: £100 to £200

- Mortgage arrangement fees: £1,000 to £2,000

- Property survey: £400 to £1,500

- Valuation fee: £150 to £800

- Removals: £150 to £2,000

- 1% repairs and maintenance: £3,500

- Homeowners Insurance: £200 - £400

- Stamp duty: 0% to 10% of home value

Even with enough saved for down payment, there are always extra expenses involved that can make purchasing property a challenge, especially for young adults.

Wahed allows you to start investing with as little as £500. This low entry point makes real estate investing accessible to everyone. Whether you’re a seasoned investor or just starting out, you can start building your property portfolio with Wahed at any stage of your life.

5. Exclusive off-market properties handpicked for you

We specialise in sourcing off-market properties that aren’t yet available to the general public, often at prices below market value. By entering at a lower price point, you could gain an immediate buffer against any market fluctuations. This means that even in the event of an economic downturn, your investment has the capacity to absorb some of the decline, potentially providing an extra layer of protection.

Not only that, since we acquire properties at below market value, the potential for profit increases as the value of property rises. By the time we decide to sell the property, there’s a greater chance for you to see a return on your investment.

Our team uses its extensive network and decades of collective industry knowledge to identify and secure these deals, giving you access to high-growth properties that might otherwise be out of reach. This strategy not only increases the potential for returns, but also provides a cushion in volatile periods.

6. Earn passive income without any of the hard work

One of the most attractive aspects of real estate investing is the potential to earn consistent passive income through rental yields.

With traditional property ownership, this income isn't truly passive – you'd need to actively manage the property and tenants. But with us, you just sit back and watch the money come in. We do all the hard work, while you receive regular quarterly rental income in the form of dividends, without lifting a finger.

While the returns are not guaranteed and there can be periods of non-payments, our goal is to keep the property tenanted in order to facilitate regular disbursements.

7. Invest in as many properties as you like

Ever come across the advice to not keep all your valuables in one place? In the world of investing, we call this “diversification” – that essentially means spreading your investments across different assets to minimise risk.

With traditional real estate, diversifying often means buying multiple properties, which is out of reach for most people. You might end up investing all your savings into one property, and if something goes wrong, you’re in hot waters.

Meanwhile, Wahed gives you the freedom to invest in as many properties as you like. You could have a share in an apartment in London, a house in Manchester or in the future, potentially a luxury apartment in Edinburgh, all accessible with a relatively small investment.

This approach not only softens the impact of local market fluctuations but also improves your chances of generating better returns.

8. Invest from the comfort of your phone

Gone are the days when investing in properties meant in-person viewings and stacks of paperwork. Wahed’s user-friendly app offers a convenient way to invest and manage your real estate investments directly from your phone.

You can keep track of your portfolio, monitor how much income you’re getting and invest in new properties – all with just a few taps.

The app simplifies the investment process, making it more accessible and convenient, allowing you to stay on top of your investments no matter where you are.

Conclusion

Investing in real estate with Wahed means no more paperwork, no more stress, no more difficult tenants and no more Riba. We handle all the details so you can focus on building your wealth.

Whether you're new to investing or are looking to expand your portfolio, Wahed offers a simple solution to get you started!

Note: Remember, while real estate can be a valuable addition to your investment portfolio, it's important to consider your personal financial situation and goals before making any investment decisions.

Risk Warning: Equity investments are not readily realisable and involve risks, including loss of capital, illiquidity, lack of dividends and dilution, and it should be done only as part of a diversified portfolio. Investments of this type are only for investors who understand these risks. You will only be able to invest in the company once you have met our conditions for becoming a registered member.

Please visit www.wahed.com/uk/ventures/risk for our full risk warning.

Risk Warning: As with any investment, a Wahed Invest Ltd investment puts your money at risk, as the value of your investment can go down as well as up. The tax treatment of your investment will depend on your individual circumstances and may change in the future. If you are unsure about whether investing is right for you, please seek expert financial advice.

Please visit www.wahed.com for our full terms and conditions

Maydan Capital Limited, trading as WahedX, is registered in England and Wales (Company No. 13451691), registered office: 87-89 Baker Street, London, W1U 6RJ, UK. Maydan Capital Ltd (FRN: 963613) is an appointed representative of Wahed Invest Ltd (FRN: 833225), an authorised and regulated firm by the Financial Conduct Authority.Wahed Invest Ltd. is registered in England and Wales (Company No. 10829012), registered office: 87-89 Baker Street, London, W1U 6RJ, UK and is authorised and regulated by the Financial Conduct Authority: FRN 833225.

Subscribe For More Islamic Finance Content

As with any investment, a Wahed Invest Ltd investment puts your money at risk, as the value of your investment can go down as well as up. The tax treatment of your investment will depend on your individual circumstances and may change in the future. If you are unsure about whether investing is right for you, please seek expert financial advice.

Wahed Invest LLC (Wahed) is a US Securities and Exchange Commission (SEC) registered investment advisor. Wahed Invest provides brokerage services to its clients through its brokerage partner Apex Clearing Corporation, a member of NYSE - FINRA - SIPC and regulated by the SEC and the Commodity Futures Trading Commission. Registration does not imply a certain level of skill or training. Wahed does not intend to offer or solicit anyone to buy or sell securities in jurisdictions where Wahed is not registered or a region where an investment practice like this would be contrary to the laws or regulations. Any returns generated in the past do not guarantee future returns. All securities involve some risk and may result in loss. Any performance displayed in the advertisements or graphics on this site are for illustrative performances only.

Disclaimer: Wahed Technologies Sdn Bhd ("Wahed") is a Digital Investment Manager (DIM) licensee issued by Securities Commission Malaysia (eCMSL/ A0359/2019). It is part of Wahed Inc. Wahed is authorized to conduct a fund management business that incorporates innovative technologies into automated portfolio management services offered to clients under a license issued pursuant to Schedule 2 of the Capital Markets Services Act 2007. All investments involve risks, including the possibility of losing the money you invest, and the track record does not guarantee future performance. The history of returns, expected returns, and probability projections is provided for informational and illustrative purposes, and may not reflect actual future performance. Wahed is not responsible for liability for your trading and investment decisions. It should not be assumed that the methods, techniques, or indicators presented in this product will be profitable, or will not result in losses. The previous results of any trading system published by Wahed, through the Website or otherwise, do not indicate future returns by that system, and do not indicate future returns that will be realized by you.

Wahed Invest Limited is regulated by ADGM’s Financial Services Regulatory Authority (“FSRA”) as an Islamic Financial Business with Financial Services Permission for Shari’a Compliant Regulated Activities of Managing Assets and Arranging Custody [Financial Permission No. 220065]. Our ADGM Registered No. is 000004971.

Wahed assumes no obligation to provide notifications of changes in any factors that could affect the information provided. This information should not be relied upon by the reader as research or investment advice regarding any issuer or security in particular. Any strategies discussed are strictly for illustrative and educational purposes and should not be construed as a recommendation to purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. Furthermore, the information presented may not take into consideration commissions, tax implications, or other transactional costs, which may significantly affect the economic consequences of a given strategy or investment decision. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance.

There is no guarantee that any investment strategy will work under all market conditions or is suitable for all investors. Each investor should evaluate their ability to invest long term, especially during periods of downturn in the market. Investors should not substitute these materials for professional services and should seek advice from an independent advisor before acting on any information presented. Any links to third-party websites are provided strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided at these websites nor do we endorse the content and information contained on those sites. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the third-party websites.