401K Reality Check: The Realities of Retirement For Muslims

In today's world, the idea of a comfortable retirement has become more of a dream than a reality for many Americans. Please don't take our word for it, though. The Employee Benefit Research Institute ran its annual retirement confidence survey, and the results speak for themselves.

“Compared with 2022, both workers’ and retirees’ confidence have significantly dropped and returned to levels last seen in 2018. The last time a decline in confidence of this magnitude was observed was in 2008 during the global financial crisis”

As of today, confidence levels towards retirement amongst both workers and retirees are at their lowest since 2018¹. As we explore the root causes - rising inflation, growing retirement costs, and limited retirement funds - behind this nationwide confidence gap, the importance of having the right investment strategy and partner has never been more apparent.

Inflation and Retirement: The Battle for Your Savings

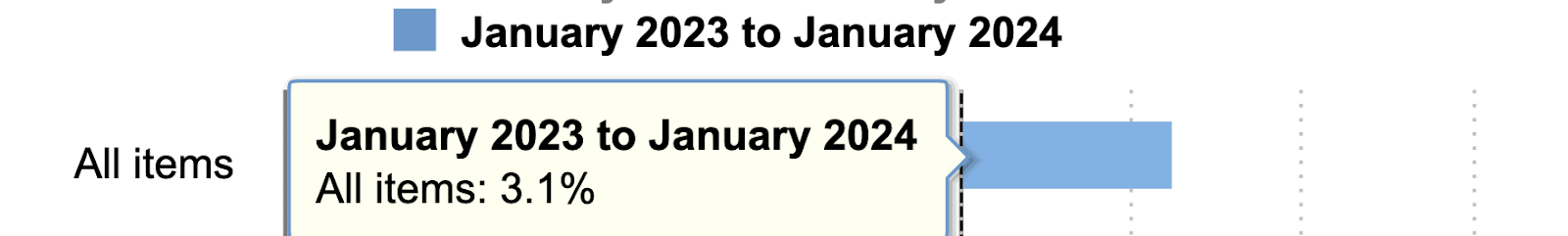

Bureau of Labour Statistics (BLS) Inflation rate projection for 2024²

In 2024, the Bureau of Labor Statistics (BLS) expects an inflation rate of around 3.1%². Many people don't realize the effect this has on one's retirement fund. If your investments aren't keeping pace with the annual inflation rate, you're essentially losing money. For many, especially those relying on low-yield savings accounts that offer minimal returns, this situation translates to a savings account that is slowly being chipped away year after year.

Now, for us in the Muslim community, the challenge doesn't stop there. Our faith guides us to steer clear of Riba, making our investment choices somewhat limited and with the lack of Riba-Free Retirement Solutions available, it can sometimes feel like the deck is stacked against us.

The Rising Costs of Life

They say a rising tide lifts all boats; well, in this case, that tide is inflation, and that boat represents your retirement living expenses.

“Americans Estimate they’ll need $1.3 Million to retire comfortably”

In fact, many Americans now estimate that they'll need at least $1.3 million to retire comfortably³. What does comfortably mean, however? That answer will vary from person to person, but what we can all agree on is that we all need a place to live, food to eat, and treatment when life takes its inevitable toll. Unfortunately, due to inflation, all of these basic living expenses will surge upwards, leaving many Americans and members of our community feeling unprepared for the financial realities of retirement.

The Consequences of Poor Saving Habits

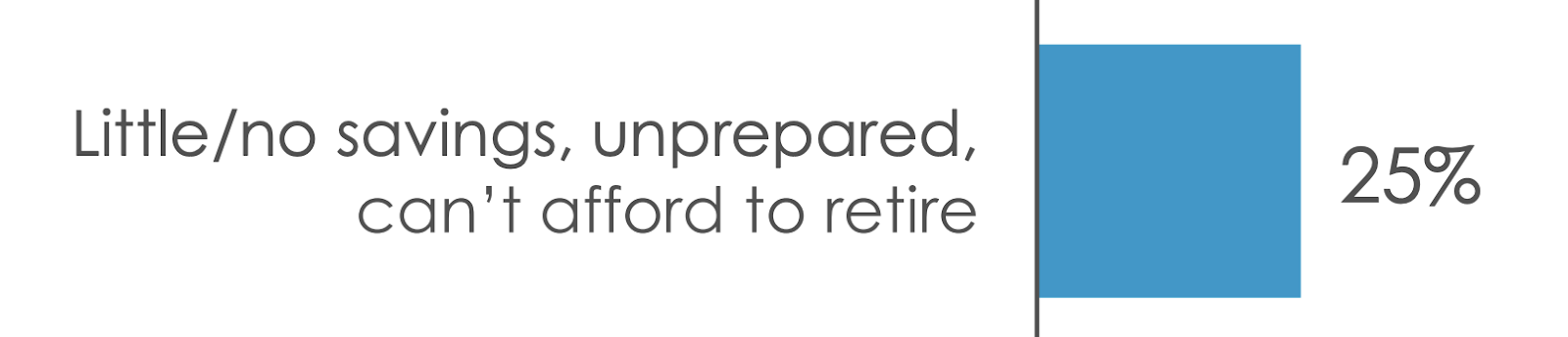

If you had to guess the percentage of retirees worried about their retirement due to having little or no savings, what would that number be? You might be surprised to know that according to the Employment Benefit Research Institute’s (EBRI) confidence survey, 25% of retirees feel unprepared for the future due to having little to no savings¹.

EBRI Retirement Confidence Report 2023¹

This lack of preparedness can be attributed to many factors, including the high cost of living associated with inflation, poor saving habits leading up to retirement, and a lack of understanding of available investment options. Whatever the case, not having enough in the bank during one's golden years can quickly turn the retirement you've always dreamed of into a nightmare.

It's Never to Late

The challenges we've listed are difficult to hear, but they are the realities of what retirement looks like in the modern day if you fail to take the appropriate steps. However, there is light at the end of the tunnel in the form of the right investment strategy and partner to help you navigate towards a brighter future aligned with your financial goals and faith.

By choosing a Halal⁴ IRA (Individual Retirement Account) with one of Wahed's portfolios, you can begin to take the first few steps toward the retirement you've always envisioned without having to compromise your principles. At Wahed, our goal is to provide our community with the highest-quality, Riba-free retirement solutions that can one day bring a future free from financial worries.

Remember that it's never too early to start saving for tomorrow. As you navigate the complexities of retirement planning, know that we are here to support you every step of the way.

If you'd like to learn more about how our halal IRAs can help you on your retirement journey, follow the link below.

Disclaimers:

*Consult with your tax or financial advisor before implementing any plan changes as your situations may vary.

Sources:

1. Employee Benefit Research Institute (EBRI) - Retirement Confidence Report 2023: https://www.ebri.org/docs/default-source/rcs/2023-rcs/2023-rcs-short-report.pdf - Page 14

2. Bureau of Labor Statistics (BLS) - Inflation Rate Projection for 2024: https://www.bls.gov/opub/ted/2024/consumer-prices-up-3-1-percent-from-january-2023-to-january-2024.htm

3. CNBC - Survey on American Retirement Savings: https://www.cnbc.com/2023/09/08/56percent-of-americans-say-theyre-not-on-track-to-comfortably-retire.html

4. Halal: The term 'Halal' denotes that it is permitted and follows Islamic law.

Risk Warning: Equity investments are not readily realisable and involve risks, including loss of capital, illiquidity, lack of dividends and dilution, and it should be done only as part of a diversified portfolio. Investments of this type are only for investors who understand these risks. You will only be able to invest in the company once you have met our conditions for becoming a registered member.

Please visit www.wahed.com/uk/ventures/risk for our full risk warning.

Risk Warning: As with any investment, a Wahed Invest Ltd investment puts your money at risk, as the value of your investment can go down as well as up. The tax treatment of your investment will depend on your individual circumstances and may change in the future. If you are unsure about whether investing is right for you, please seek expert financial advice.

Please visit www.wahed.com for our full terms and conditions

Maydan Capital Limited, trading as WahedX, is registered in England and Wales (Company No. 13451691), registered office: 87-89 Baker Street, London, W1U 6RJ, UK. Maydan Capital Ltd (FRN: 963613) is an appointed representative of Wahed Invest Ltd (FRN: 833225), an authorised and regulated firm by the Financial Conduct Authority.Wahed Invest Ltd. is registered in England and Wales (Company No. 10829012), registered office: 87-89 Baker Street, London, W1U 6RJ, UK and is authorised and regulated by the Financial Conduct Authority: FRN 833225.

Subscribe For More Islamic Finance Content

As with any investment, a Wahed Invest Ltd investment puts your money at risk, as the value of your investment can go down as well as up. The tax treatment of your investment will depend on your individual circumstances and may change in the future. If you are unsure about whether investing is right for you, please seek expert financial advice.

Wahed Invest LLC (Wahed) is a US Securities and Exchange Commission (SEC) registered investment advisor. Wahed Invest provides brokerage services to its clients through its brokerage partner Apex Clearing Corporation, a member of NYSE - FINRA - SIPC and regulated by the SEC and the Commodity Futures Trading Commission. Registration does not imply a certain level of skill or training. Wahed does not intend to offer or solicit anyone to buy or sell securities in jurisdictions where Wahed is not registered or a region where an investment practice like this would be contrary to the laws or regulations. Any returns generated in the past do not guarantee future returns. All securities involve some risk and may result in loss. Any performance displayed in the advertisements or graphics on this site are for illustrative performances only.

Disclaimer: Wahed Technologies Sdn Bhd ("Wahed") is a Digital Investment Manager (DIM) licensee issued by Securities Commission Malaysia (eCMSL/ A0359/2019). It is part of Wahed Inc. Wahed is authorized to conduct a fund management business that incorporates innovative technologies into automated portfolio management services offered to clients under a license issued pursuant to Schedule 2 of the Capital Markets Services Act 2007. All investments involve risks, including the possibility of losing the money you invest, and the track record does not guarantee future performance. The history of returns, expected returns, and probability projections is provided for informational and illustrative purposes, and may not reflect actual future performance. Wahed is not responsible for liability for your trading and investment decisions. It should not be assumed that the methods, techniques, or indicators presented in this product will be profitable, or will not result in losses. The previous results of any trading system published by Wahed, through the Website or otherwise, do not indicate future returns by that system, and do not indicate future returns that will be realized by you.

Wahed Invest Limited is regulated by ADGM’s Financial Services Regulatory Authority (“FSRA”) as an Islamic Financial Business with Financial Services Permission for Shari’a Compliant Regulated Activities of Managing Assets and Arranging Custody [Financial Permission No. 220065]. Our ADGM Registered No. is 000004971.

Wahed assumes no obligation to provide notifications of changes in any factors that could affect the information provided. This information should not be relied upon by the reader as research or investment advice regarding any issuer or security in particular. Any strategies discussed are strictly for illustrative and educational purposes and should not be construed as a recommendation to purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. Furthermore, the information presented may not take into consideration commissions, tax implications, or other transactional costs, which may significantly affect the economic consequences of a given strategy or investment decision. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance.

There is no guarantee that any investment strategy will work under all market conditions or is suitable for all investors. Each investor should evaluate their ability to invest long term, especially during periods of downturn in the market. Investors should not substitute these materials for professional services and should seek advice from an independent advisor before acting on any information presented. Any links to third-party websites are provided strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided at these websites nor do we endorse the content and information contained on those sites. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the third-party websites.