Investor Terms and Conditions

Version : 26th July 2024

1. INTRODUCTION

1.1. We operate a Platform to facilitate investment in shares and other investments by you, as set out in these Terms and Conditions.

1.2 These Terms and Conditions, along with the other documents set out at Clause 3.1 below, constitute your contract with us when you use the Platform.

1.3 It is important that you read these Terms and Conditions and all the Platform Agreements carefully. Please print a copy of these Terms and Conditions for future reference. A link to the latest version of these Terms and Conditions for you to download or print (and the amendment history) will also be available on the Platform under your account settings. If you have any questions on the Terms and Conditions, please contact us at support.ventures@wahed.com or in our digital application live chat.

1.4 The Glossary in Schedule 1 to these Terms and Conditions sets out the definitions of words and phrases used in these Terms and Conditions and gives the rules for interpreting them. The definitions and rules of interpretation in the Glossary affect the meaning of these Terms and Conditions so it is important that you refer to the Glossary in reading these Terms and Conditions.

1.5 IMPORTANT: We do not provide any advice on the merits of any Offer made available via the Platform nor do we make any personal recommendations on any Investments. If you are unsure of any investment decision, you should seek the advice of a professional financial adviser.

2. ABOUT US

2.1 Wahed X Sdn. Bhd. (202301007193 (1501114 - X)), a firm authorised and regulated by the Securities Commission Malaysia.

2.2 By operating the Platform, we are acting as a non-advisory intermediary. This means that we may:

2.2.1 introduce you to investment opportunities with Fundraising Companies,

2.2.2 Pass your investment requests or other instructions to the Custodian or to the Fundraising Companies,

2.2.3 act as your agent to:

- arrange for the Custodian to hold Client Money for you;

- depending on the Services that we provide arrange for the Custodian to purchase Investments in accordance with your instructions, and

- depending on the Services that we provide arrange for the Custodian to safeguard Investments on your behalf, and

2.2.4 enables you to view all Investments arranged through the Platform, either online or via our app.

2.3 We will not:

2.3.1 hold or safeguard your Investments or your money,

2.3.2 deal in any investments (either on our own behalf, or as your agent),

2.3.3 provide investment advice, or

2.3.4 provide portfolio management.

2.4 We hereby declare and assure that we are committed to upholding the principles of Shari’ah (Islamic law) in all its operations, transactions, and engagements. In line with this commitment, we exclusively partner with, engage, and utilize service providers, vendors, and third parties (collectively referred to as “Service Providers”) that are verified to be compliant with Shari’ah principles and guidelines.

2.5 IMPORTANT: We facilitate the process of investing in various opportunities. As an Investor, you are solely responsible for the management of your portfolio and for making all your investment decisions. We do not provide any form of investment advice or portfolio management services. All investment decisions are made at your discretion and should be based on your own judgement. You understand and accept that you assume all risks associated with your investment choices. We strongly recommend that you seek independent advice from a qualified financial adviser if you are uncertain about any aspect of your investment decisions.

3. OUR AGREEMENT WITH YOU

3.1. When you submit an application to become an Investor on our Platform, you accept and agree to comply with these Terms and Conditions. These Terms and Conditions form the basis of a binding agreement between you and us which consists of:

3.1.1 these Terms and Conditions,

3.1.2 the Additional Terms applicable to any of your Investments, and

3.1.3 Wahed Groups’s cookie policy, privacy policy, conflicts of interests policy, Platform terms of use and all terms and conditions of Wahed Group published on its Platform as updated from time to time,

(together, the Platform Agreements).

3.2 The Platform Agreements (including these Terms and Conditions) are our client agreement with you. The Platform Agreements set out all the terms agreed between you and us with respect to your use of the Platform. We may make changes to the Platform Agreements from time to time, as set out in Clause 21. If you do not agree with any provision of these Terms and Conditions, or any other provision of the Platform Agreements, you must not make any further use of the Platform.

3.3 You acknowledge and agree that our assurance of engaging only Shari’ah-compliant Service Providers is a testament to its commitment to Shari’ah principles. However, we do not bear liability for any direct or indirect non-compliance by any Service Provider with Shari’ah principles, provided that the Platform acted in good faith and exercised due diligence in the selection and engagement of such Service Providers.

By investing through the Platform, you affirm your understanding and acceptance of this clause, acknowledging the Platform’s efforts to maintain a Shari’ah-compliant environment and agreeing to raise any concerns regarding Shari’ah compliance directly with the Platform for resolution.

3.4 In the event of a conflict between these Terms and Conditions and the Additional Terms, the Additional Terms shall prevail.

3.5 These Terms and Conditions do not apply to Fundraising Companies. We may enter into a separate agreement with each Fundraising Company.

4. REGISTERING AS AN INVESTOR

4.1 To register as an Investor on our Platform, you must:

4.1.1 (if you are an individual) be at least 18 years old, and provide us with any identification documents which we may request, or

4.1.2 (if you are not an individual, for example because you are a company), provide us with such confirmation of status or other documents as we may request.

4.2 By registering as an Investor, you confirm that:

4.2.1 (if you are an individual) you live in the Malaysia,

4.2.2 you are resident in the Malaysia for tax purposes,

4.2.3 (if you are a retail client) you are:

(a) a Retail Investor,

(b) a Angel Investor, or

(c) a Sophisticated Investor,

4.2.4 you have read the non-exhaustive risk warnings at Clause 16 of these Terms and Conditions, in the Risk Warning Notice and any other risk warnings set out on the Platform, and are prepared and able to accept the risks of investing via our Platform,

4.2.5 (if you are not an individual, for example, because you are a company), you confirm that you have the appropriate internal and any external, including regulatory (if required) authorisations to enter into the Platform Agreements,

4.2.6 except as specifically agreed in writing with us, you invest on your own account and you do not invest on behalf of a third-party. All orders for Investments made through the Platform are made exclusively on your own behalf. You confirm that you are not acting as trustee, broker, investment manager or in any other capacity as representative of a third party,

4.2.7 (if you are an individual) you have not been, nor do you reasonably anticipate that you may be, declared bankrupt or unable to pay your debts or other liabilities,

4.2.8 (if you are not an individual) you have not undergone, nor is it reasonably likely that you will undergo, an Insolvency Event, and

4.2.9 you are not in the middle of any dispute, proceedings, mediation or arbitration which may have an impact on your ability to hold full and unencumbered beneficial title to any Investments.

4.3 You will be deemed to repeat each of the warranties and representations (as applicable to you) in Clause 4.2 each time you access the Platform, whether online or via the app. If any of the applicable warranties or representations become wholly or partially untrue or inaccurate, you must tell us and must not make any further use of the Platform.

4.4 Before we accept you as an Investor, you must provide us with certain confirmations of your status. This includes, but is not limited to, those confirmations in Clause 5.3. You must also answer, to our satisfaction, questions designed to determine your knowledge, experience and understanding of risks of investing via our Platform.

4.5 We may make further enquiries or obtain further documents in connection with your application to use the Platform as we consider appropriate (including any that are referred to in Clause 19 of these Terms and Conditions).

4.6 You must provide accurate and truthful information in response to any questions which we ask you. You must also make any declarations which we may ask you to give when you register as an Investor truthfully.

4.7 We may in our discretion refuse to allow you to use the Platform and/or may refuse to make certain Offers or Investments available to you. We shall not be obliged to give any reasons for our refusal. This is subject to our requirements under Applicable Law.

4.8 Where we accept you as an Investor, we are not obliged to make all Offers with Fundraising Companies available to you. We may, in our discretion, ask further questions or apply other tests before you are able to view the Offering Materials for particular Investments.

4.9 You must keep any Security Details required to access the Platform safe at all times and should not disclose them to any third party. You must inform us immediately if there is any breach of security, loss, theft or unauthorised use of the Security Details. You will be responsible for any use of the Security Details where you have allowed another person to use them deliberately, negligently or in breach of the Platform Agreements.

5. CLIENT CATEGORISATION

5.1 We will categorise you as a retail client for the purpose of the Securities Commission regulations, unless we agree a different categorisation with you. As a retail client, you will have the highest level of protection under the Securities Commision regulations.

5.2 However, we may instead categorise you as a professional client, where permitted by the Securities Commission regulations. Where we do so, you must inform us of any changes in your circumstances which might affect our categorisation of you.

5.3 You may also request a different categorisation. We will consider any request you may make to have a different categorisation but we are not obliged to agree to any change in how we have categorised you.

5.4 If we have categorised you as a retail client, you will only be able to view Offers via the Platform if you have completed and signed, within the last 12 months, a statement to confirm that you are one of the following:

5.4.1. a Retail Investor,

5.4.2 a Angel Investor, or

5.4.3 a Sophisticated Investor.

This is a requirement of the Securities Commission regulations. If you consider that you no longer meet one of the categories above, you must notify us in writing as soon as possible.

5.5 In accordance with the Securities Commission Guidelines, we are obliged to apply different investment limits depending on your categorisation as an Investor. The investment limits applied will align with those stipulated by the Guidelines, including any amendments thereto.

6. SERVICES PROVIDED VIA THE PLATFORM

6.1. We shall act with reasonable care and skill, and in accordance with our regulatory obligations, when we provide the Services to you under the Platform Agreements.

6.2 The Platform enables Investors to view investment opportunities with Fundraising Companies and provide instructions to invest in Fundraising Companies.

6.3 Where you are registered as an Investor, you may view information about Offers available on our Platform, including Offering Materials.

6.4 We will comply with the Securities Commission regulations in relation to any financial promotions that we communicate or approve, including taking reasonable care to ensure that these are clear, fair or not misleading. More information on this in relation to Offering Materials is set out in Clause 7 below. We do not provide any advice on the merits of investing in any Investment made available via the Platform nor do we make any personal recommendation as to investment via the Platform. You should take such relevant advice as is appropriate in your circumstances. If you are unsure of any investment decision you should seek a professional financial adviser.

6.5 Before you agree to purchase an Investment, it is very important that you review the Offering Materials on that Investment as well as the Platform Agreements. If you are unsure about any Investment, you should seek the advice of a professional financial adviser. By agreeing to purchase an Investment, you agree that you have reviewed all the Offering Materials and the Platform Agreements.

6.6 Each Offer will have an Offer Period within which you can place an order to purchase an Investment. Each Offer Period will be made clear on the Platform. We have complete discretion to amend the Offer Period from time to time as we see fit. We may bring forward the day on which the Offer Period ends, or we may end the Offer Period immediately (for example, if the Fundraising Company has met its Target or for any other reason).

6.7 Offers on the Platform may be made in respect of:

6.7.1 Custodied Fundraising Companies, or

6.7.2 Direct Investment Fundraising Companies.

Whether an Offer relates to a Custodied Fundraising Company or a Direct Investment Fundraising Company will be made clear to you via the Platform.

6.8 Custodied Fundraising Company. If you choose to invest in a Custodied Fundraising Company via the Platform:

6.8.1 You will be required to agree to Additional Terms which relate to your order to invest in the relevant Fundraising Company before you proceed. These Additional Terms are important and you must review them carefully. We may also require you to answer further questions on your investment knowledge and experience.

6.8.2 You can then place an order with us to invest in the relevant Fundraising Company via the Platform, and the following terms will apply:

(a) Where applicable, any order must be in multiples of the price of the Investments indicated on the Platform.

(b) Any order must be placed within the relevant Offer Period.

(c) You are entitled to a Cooling-off Period of six (6) business days, during which, you have the right to withdraw your funds from the Offer.

(d) If you wish to modify or cancel your order at any time after the Cooling-off Period and before the end of the Offer Period please contact us in writing with your request. We retain full discretion to refuse any such request. Please note that the end of the Offer Period can be brought forward, or the Offer Period can be ended immediately under Clause 6.6.

6.8.3 In order to invest via the Platform, you must have deposited sufficient funds, using the payment methods specified on the Platform

6.8.4 Following the end of the Cooling-off Period and Offer Period, your order will become irrevocable. At the end of the Offer Period we will pass your order to the Custodian.

6.8.5 The Custodian will transfer a sum representing the amount of the Investments you wish to buy to the Fundraising Company and pay us our Investment Fee. The Custodian may transfer money to the Fundraising Company in one go or in instalments, if required.

6.8.6 The Fundraising Company will then arrange for the issue of your Investments to the Custodian . The Custodian will hold your Investments and your Investments will be safeguarded and administered by the Custodian in accordance with Clause 10.

6.9 Direct Investment Fundraising Company. If you choose to invest in a Direct Investment Fundraising Company via the Platform:

6.9.1 You will be required to agree to Additional Terms which relate to your order to invest in the relevant Fundraising Company before you proceed. These Additional Terms are important and you must review them carefully. We may also require you to answer further questions on your investment knowledge and experience.

6.9.2 You can then place an order with us to invest in the relevant Fundraising Company via the Platform, and the following terms will apply:

(a) Any order must be in multiples of the price of the Investments indicated on the Platform.

(b) Any order must be placed within the relevant Offer Period.

(c) You are entitled to a Cooling-off Period of six (6) business days, during which, you have the right to withdraw your funds from the Offer.

(d) You may modify or cancel your order at any time before the end of the Offer Period. Please note that the end of the Offer Period can be brought forward, or the Offer Period can be ended immediately under Clause 6.6.

6.9.3 At the end of the Cooling-off Period or the Offer Period, whichever comes later, , an amount representing the Investments you wish to purchase and our Investment Fee will be blocked in your Account in accordance with Clause 9.7. If there are insufficient funds in your Account to cover the price of the Investments you wish to buy and/or our Investment Fee (whether before or after a modification of your order), you must transfer sufficient funds to the Custodian within the Offer Period. If you do not do so, you will not be permitted to purchase the relevant Investments and you may be deemed to have breached these Terms and Conditions in accordance with Clause 9.8. Alternatively, if you cancel, or modify so as to reduce, your order before the end of the Offer Period:

(a) the amount of money which was blocked in your Account (in the case of a cancellation), or

(b) an amount of money commensurate to the amount by which you have decided to reduce your order (in the case of a modification so as to reduce your order)

will subsequently be made freely available to you.

6.9.4 At the end of the Cooling-off Period and Offer Period your order will become irrevocable. At this point we will pass your order to the Custodian. The Custodian will arrange for your Account to be debited to the amount of the Investments you wish to purchase as well as the amount of our Investment Fee.

6.9.5 The Custodian will transfer a sum representing the amount of the Investments you wish to buy to the Fundraising Company and pay us our Investment Fee. The Custodian may transfer the money to the Fundraising Company in one go or in instalments.

6.9.6 The Fundraising Company will then issue your Investments to you. You will hold your Investments directly and neither we nor the Custodian will hold these Investments on your behalf and Clause 10 will not apply. You will be responsible for safeguarding your Investments and the safekeeping of any documents issued in relation to your Investments, such as share certificates.

6.10 Cooling-off Period. Upon placement of an order towards an Offering, you are entitled to a six (6) business day Cooling-off Period. During this period, you have the right to withdraw the full amount of your funds for the said Offer. The Cooling-off Period commences on the day of your placement of an order for an Offering and ends at the close of business on the sixth business day following the placement.

6.11 To exercise your right to withdraw during the Cooling-off Period, you must provide us with a written notice of your intention to withdraw within the Cooling-off Period. This notice must clearly state your intention to withdraw, the amount of funds to be withdrawn, and the details of the relevant Offer.

6.12 In the event where the Cooling-off Period extends beyond the expiry of the Offer Period, you retain the right to withdraw the full amount of your funds until the end of the Cooling-off Period.

6.13 Cancellation of Order. If you have placed an order with us to purchase an Investment with a Fundraising Company, and you can no longer purchase those Investments because: (a) the Fundraising Company has not met its Target and may no longer proceed with the Offer, (b) the Fundraising Company withdraw its Offer, or (c) there has been a material adverse change concerning the Fundraising Company or the Offering, or (d) within the Cooling-off Period, you notify us in writing to cancel your order, or (e) for any other reason which we may decide, or (f) you notify us in writing that you wish to cancel your order and we have agreed to such a request, the Custodian will arrange for the amount of the money which has been blocked in your Account or deposited (as applicable) to subsequently be transferred back to you.

7. OFFERING MATERIALS

7.1 The Securities Commission regulations require us to ensure that any materials available on the Platform which are capable of being a financial promotion are, to the best of our knowledge and belief, clear, fair and not misleading (unless an exemption applies).

7.2 We do not:

7.2.1 provide any form of legal, tax, financial or other advice or recommendation in respect of any Offer, or

7.2.2 make any representation as to the returns or otherwise of Investments nor of the Malaysia or overseas tax treatment of Investments.

7.3 Prior to the upload of any Offering Materials to the Platform, we conduct a due diligence exercise. This process aims to verify the accuracy of the information provided by the Fundraising Company. However, this should not be construed as a guarantee of the veracity or completeness of the information contained in the Offering Materials. Despite our rigorous due diligence, potential inaccuracies or omissions may still occur. Therefore, Investors are highly encouraged to perform their own additional due diligence and seek professional advice where necessary.

7.4 We will not be liable for any loss or damage resulting from any inaccuracies or omissions identified in the Offering Materials after our due diligence process.

7.5 We make no warranty or representation in respect of the content of the Offering Materials or any content posted on the Platform.

7.6 We will not be liable for any loss or damage suffered by you or any third party in connection with your reliance on the Offering Materials or any content posted on the Platform.

7.7 In particular, you should be aware that:

7.7.1 Fundraising Companies may be early-stage or growth companies or may look to invest in investments or assets where the return is not guaranteed (or both). Accordingly, the Offering Materials may contain forward-looking and / or aspirational statements which are not achieved in practice. We will not be liable if forward-looking or aspirational statements set out in the Offering Materials are not achieved.

7.7.2 The Offering Materials may contain statements on Malaysian tax. We make no warranty or representation on any statements on Malaysia tax set out in any Offering Materials. The tax system in Malaysia can change significantly within relatively short periods of time and we will not be liable for any loss or damage suffered by you or a third party in connection with any Malaysia tax benefit in relation to an Investment being withdrawn or reduced.

7.8 If, prior to the end of the Offer Period, we become aware of any material adverse change concerning the Issuer’s that is likely to affect the content or validity of the Offering Materials, we will take reasonable steps to promptly inform you of such changes. We retain the sole discretion to terminate the Offering. In the event of such termination, Clause 6.1 shall apply.

8. THE CUSTODIAN

8.1 We do not hold your money, nor do we hold any of your Investments.

8.2 Any Client Money belonging to you and which is held in connection with any of your Investments will be held by the Custodian in accordance with Clause 9.

8.3 Your Investments in Custodied Fundraising Companies will be held by the Custodian in accordance with Clause 10.

8.4 The Custodian will hold any Client Money belonging to you, and safeguard and administer any of your Investments in Custodied Fundraising Companies, in accordance with the Trust Deed between us and the Custodian. The Custodian is authorised and regulated by the Securities Commission and has regulatory permission to hold Client Money and safeguard and administer client assets as per the CMSA 2007.

8.5 By entering into the Platform Agreements, you consent to us, acting as your agent, appointing the Custodian to hold your Client Money and your Investments (as applicable) on your behalf, in accordance with these Terms and Conditions.

8.6 You will not communicate directly with the Custodian. You will also not send orders or other instructions to the Custodian. All orders, instructions or other communications should be made via the Platform.

8.7 You acknowledge that the Custodian is not a party to this Agreement. The Custodian’s role is primarily administrative in nature, and it acts predominantly upon the instructions of the ECF Operation in relation to the holding and administration of your Client Money and Shares. Notwithstanding, the Custodian does maintain a degree of oversight to ensure compliance with applicable laws and regulations and the terms of the Trust Deed. All actions taken by the Custodian in connection with the shares will be under the direction of the ECF Operator, and in accordance with applicable laws, regulations, and the terms of the Trust Deed.

9. CLIENT MONEY

9.1 In order to invest via the Platform, you must have deposited sufficient funds with the Custodian, using the payment methods specified on the Platform.

9.2 Money deposited by you will be held by the Custodian as Client Money in accordance with the Securities Commission Guidelines.

9.3 Any amounts received which are owed to you (including any dividends, other returns on any Investments, or distributions) will also be held by the Custodian as Client Money in accordance with the CMSA 2007.

9.4 If you wish to have Client Money paid to you, please provide an instruction via the Platform and we will arrange for the Custodian to pay this to your nominated bank account.

9.5 All Client Money will be held by the Custodian in a segregated account. The Custodian will maintain records showing the amount of Client Money it holds for each Investor, in accordance with the Securities Commission regulations.

9.6 Where Client Money is held for you, we will open a segregated account where all Client Money will be held by the Custodian in a consolidated account . The Account will reflect Client Money held for you by the Custodian. Please note that the Account merely provides details on the Client Money held by the Custodian for you and does not mean that we hold Client Money for you.

9.7 The Client Money may not be used for any other purpose or withdrawn unless your order for the Investment or your Investments cannot be purchased in accordance with Clause 6.12.

9.8 Where you have agreed to invest you must transfer sufficient funds to the Custodian within the Offer Period. If you fail to do so:

9.8.1 we may regard this as a material breach of these Terms and Conditions and may terminate these Terms and Conditions in accordance with Clause 20, and

9.8.2 you will be liable for any loss or damage suffered by us, the Custodian, the relevant Fundraising Company or any other third party as a directly foreseeable consequence of such failure.

9.9 No interest shall be payable on any Client Money.

10. CUSTODY ARRANGEMENTS

10.1 When you make an investment in a Custodied Fundraising Company, your Investments will be issued by the Fundraising Company to the Custodian . Your Investments will then be held by the Custodian .

10.2 The Custodian will hold your Investments on trust for you. This means that the Custodian will hold the legal title of your Investments and will be recorded as the holder on the Fundraising Company’s register. The Custodian will safeguard and administer your Investments and exercise oversight of your Investments.

10.3 Where the Custodian holds Investments on your behalf:

10.3.1 This will be done in accordance with the Securities Commission Guidelines and any applicable law. The Custodian will be responsible for ensuring that your Investments are held in accordance with the Securities Commission Guidelines and any applicable law.

10.3.2 In particular, the Custodian will hold and record your Investments separately from any of our assets, those of the Wahed Group or the Custodian’s own assets, and in such a way that the Custodian can identify your Investments at any time.

10.3.3 Your Investments will typically be held by the Custodian . However, the Custodian may arrange for your Investments to be held instead by a third party (including a custodian or depositary). The Custodian will only do this where it is consistent with Applicable Law and local market practice. The Custodian will act in good faith and with due diligence in the use and monitoring of such third parties.

10.3.4 The Custodian will arrange for the segregation of your Investments from the investments of other investors who are not associated with us when your Investments are held by the Custodian . However, any third party appointed by the Custodian may hold investments in an ‘omnibus account’, meaning that your Investments may be pooled with the Investments of other Investors and other assets not associated with the Platform. This means that where there is a shortfall in assets held (for example, on the insolvency of a third party holding those assets) you may share proportionately in that shortfall with other clients (i.e. you may suffer loss).

10.3.5 The Custodian and/or a third party may have a security interest, lien or right of set-off over your Investments as well as any money arising from your Investments. This means that they may realise your Investments or deduct sums from any money held on your behalf to satisfy any obligations which you or we may owe to them.82

10.4 All notices and communications in respect of your Investments will be prepared and provided by the Custodian but will be made available to you via the Platform. In particular, an updated statement of your Investments will be provided to you via the Platform, as and when they become available. The basis of valuations, and the dates at which your Investments were last valued, will also be disclosed via the Platform.

10.5 Should there be any changes to the Custodian, including but not limited to change in identity or alteration in their terms of service, we will provide you with timely notification. This notification will outline the nature of the change, and, where applicable, provide you with the new terms of service.

11. RESTRICTIONS RELATED TO TRANSACTIONS

We may, in our discretion, impose daily restrictions on orders that can be made via the Platform. This may include, but is not limited to, us imposing size limits for Investments or other transactions or not permitting any Investments to be purchased on any given day or for any specified period.

12. ADMINISTRATION DURING THE INVESTMENT PERIOD

12.1 Where you own Investments in a Custodied Fundraising Company, during the Investment Period, you agree that the We may:

12.1.1 arrange for the Custodian to account to you (or for any person as the Investor may direct) for all dividends or other money paid or payable in respect of your Investments,

12.1.2 instruct the Custodian to hold for you all bonus shares, rights issue shares or other assets or benefits acquired relating to your Investments,

12.1.3 instruct the Custodian to hold all shares issued on the exercise of warrants and options (if any) related to your Investments,

12.1.4 instruct the Custodian to execute agreements and documents which relate to your Investments and which we deem to be in your best interests,

12.1.5 instruct the Custodian to exercise all voting or other rights or privileges related to your Investments which the Custodian is entitled to exercise,

12.1.6 instruct the Custodian to exercise all rights, powers and privileges which the Custodian is entitled to exercise under any articles of association or similar governance documents related to your Investments,

12.1.7 execute proxies to enable you to attend and vote at any meetings of an Issuer. The Custodian may charge an additional fee for the execution of any proxies and for any arrangement enabling you to vote,

12.1.8 attend any meetings held by Issuers and arrange for the representative of the Custodian to vote as the Custodian may see fit,

12.1.9 deduct our fees from any amounts received by the Custodian in respect of your Investments, and

12.1.10 collect our Exit Fee (and any other fees, if applicable) on the occurrence of an Event.

12.2 Please notify us in writing if you wish to attend any meetings, or any events requiring investor participation, of any Issuers that you have invested. Once we have informed the Issuer and the Custodian, and you have executed a proxy, you will be entitled to vote at any meetings or events of the Issuer.

12.3 If an Issuer pays a dividend or other money paid or payable in respect of one of your Investments, then we shall instruct the Custodian to pay that money to you subject to an administration fee.

12.4 For Direct Investment Fundraising Companies, you will hold your Investment in the Issuer directly. Therefore, during the Investment Period:

12.4.1 you will be responsible for exercising all rights, powers and privileges attaching to your Investments (for example, the exercise of voting rights in an Issuer), but

12.4.2 If the Fundraising Company wishes to pay to you a dividend or other money paid or payable in respect of one of your Investments, this money will be first paid to the Custodian who will hold this money as Client Money on your behalf. Once received by the Custodian, this money will be shown in your Account and will be made freely available to you.

12.5 You agree and acknowledge that we and the Custodian are not obligated to direct, advise or monitor the Issuer and its business.

13. NOTIFICATION TO YOU OF CERTAIN EVENTS AND EXIT

13.1 We will notify you if we receive a notification that one of the following Events will occur or has occurred in relation to one of your Investments:

13.1.1 there is a transaction in which the shareholders of an Issuer (including you and/or the Custodian ) are required to sell shares according to any constitutional documents or other agreements or under Applicable Law,

13.1.2 an Issuer will be acquired or merged with another entity,

13.1.3 an Issuer intends to list some or all of its shares or other instruments on a stock exchange (for example, it proposes to have an ‘initial public offering’),

13.1.4 an Issuer will be subject to one or more restructuring, winding-up or insolvency processes or proceedings, including but not limited to, entering into arrangements with its creditors, being placed into administration or being wound up in a solvent or insolvent manner (a Dissolution Event).

13.2 If the Event is a Dissolution Event, we will inform you of the final proceeds (if any) to be distributed to you as soon as reasonably possible.

13.3 If the Event allows for you or the Custodian to continue to hold your Investments, you may elect for you or the Custodian to continue to hold those Investments. You must provide us with your election within 10 Business Days of us informing you that we reasonably believe that an Event will occur or has occurred. If the Custodian has held your Investments, we may arrange for those Investments to be transferred to you.

13.4 If: (a) an Event occurs, (b) you have not elected to continue to hold your Investments, and (c) there are proceeds which are owed to you, these proceeds will be paid to the Custodian to be held on your behalf as Client Money. We will deduct our fees and charges from the proceeds held by the Custodian. The balance of these proceeds will then be returned to your designated bank account.

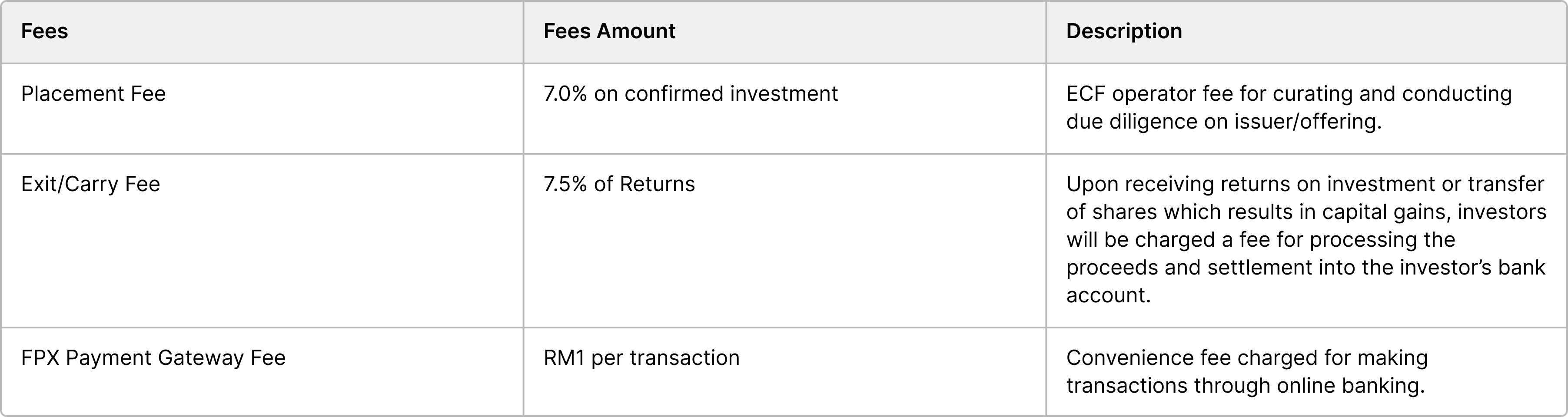

14. FEES AND CHARGES

14.1 Schedule 2 sets out the fees and charges to be paid to us in connection with your making of Investments via the Platform. The fees and charges differ depending on the underlying assets in which you make an Investment.

14.2 Further details on, and the amounts of, these fees will be disclosed to you via the Platform in the Offering Materials and/or the Additional Terms. This shall include all costs and charges information required by the Securities Commission regulations. These details will be available before you agree to purchase an Investment.

14.3 You agree that we may instruct the Custodian to deduct fees due to us or any third party from any money received by you in respect of any of your Investments, any money held for you by the Custodian. In the event that the money held is not sufficient to cover any amount which you owe us, we may arrange for an invoice to be issued to you for the full amount owed.

14.4 You should be aware that you may also incur fees and charges in connection with your use of a payment service provider or bank. You should check these with your payment service provider or bank.

14.5 All sums payable under the Platform Agreements are exclusive of any tax or other applicable sales tax, which shall be added to the sum in question. They also exclude any stamp duty tax, stamp duty reserve tax or other similar taxes that may be payable on the trading and transfer of Investments.

15. RISKS

Please read the risks in this Clause and the Risk Warning Notice carefully before committing to purchase an Investment via the Platform.

15.1 Investing via our Platform is inherently risky. You should consider the risks set out in this Clause, the Risk Warning Notice and in the Offering Materials carefully before deciding to invest or trade via our Platform. Please note that the risks set out in these Terms and Conditions and the Risk Warning Notice are designed to provide a point of reference and may not be exhaustive. You should carefully assess the risks of each Investment before purchasing that Investment.

15.2 If you invest via our Platform you should consider making it a part of a diversified portfolio, containing different types of investments with varying characteristics and risks.

15.3 You should carefully consider your own tax position and seek independent appropriate advice on the tax consequences of investing via our Platform. Tax treatment can differ from person to person depending on a person’s circumstances and may change in the future.

15.4 We can answer any questions you may have as to the factual and operational aspects of our Platform but at no time will we provide investment, financial, legal or taxation advice to any person. If you need advice as to whether any Investment on our Platform is suitable for your personal circumstances, you should consult an independent personal adviser who is experienced in advising on Investments of this kind.

15.5 Company equity (also called company shares) has the following specific risks:

15.5.1 share prices can go down as well as up – this is particularly so for smaller companies, as the combination of both fewer shares and buyers of those shares means the share price can change more rapidly,

15.5.2 dividend growth is not guaranteed, nor are companies obliged to pay a dividend to you as an investor,

15.5.3 companies may go insolvent rendering the shares you hold valueless,

16.5.4 the company’s earnings generally may be volatile, and

15.5.5 for smaller companies, shares may not obtain their full value on sale if there is difficulty finding a buyer for those shares. Any investment you make will be illiquid as a further sale of shares is not guaranteed. In some cases where an Issuer holds property, it will be dependent on the sale of the property asset.

15.6 Past performance should not be used as a reliable indicator as future potential is unknown and is independent of past performance.

15.7 If an Issuer becomes insolvent, you may lose some or all of your Investment. There is always a risk that you will not get your money back.

15.8 All listed Investments are medium to long term investments and your capital will not be readily realisable. Please read the risks pages in each of the Offering Materials in relation to the risks associated with any particular Offer.

15.9 Property: If an asset owned by an Issuer receives rent, this will be paid to you and the other shareholders in the Issuer in the form of dividends, net of any fees, costs and expenses payable. In the event that the property does not produce rent or the amount of rent received is less than the amount of fees, expenses and costs payable, no dividends will be paid. As such, there is a risk that you will not see a return on your investment.

15.10 Overseas investments: these have the risk that they are priced in a currency other than pounds sterling (this being the currency of your Investments). If the exchange rate between pound sterling and other overseas currency changes, such that the same value of overseas currency is worth less pounds sterling, this will cause your investment to lose value. Conversely, the opposite may happen, in which case there will be an increase in the value of your investment. Please note that the effect of investing overseas is separate to and in addition to the actual investment itself.

15.11 Investments in emerging markets: emerging markets can have, in addition to the risks involved in investing overseas, significant political, regulatory and economic risks. These may differ in kind and degree from the risks presented by investments in the world’s major markets. These investments have a greater risk of a sudden fall in value, for example if there is difficulty selling them, or as a result of governmental interference.

15.12 Please note that there may be other risks in addition to those outlined above in relation to your investment, and there may be further risks that arise in the future.

15.13 We do not guarantee or offer assurances as to any Investment which you purchase, and asset prices can go down as well as up. You should not invest unless you are prepared to lose all the money you invest. You should not invest any more money than you are able to afford to lose without altering your standard of living.

15.14 You acknowledge that the investments made through the Platform carry inherent risks and that the investment in securities is speculative and involves a high degree of risk. You agree to assume all risks associated with the investments and acknowledge that we make no guarantees with respect to the performance of the investments.

16. CONFLICTS OF INTEREST

16.1 We will always seek to act in your best interests. However, circumstances can arise where we or one of our other clients may have some form of interest in business being transacted for you. If this happens or we become aware that our interests or those of one of our other clients conflict with your interests, we will act in accordance with our Conflicts of Interest policy (a copy of which is available upon request). Examples of potential conflicts of interest which we may encounter are:

16.1.1 we receive fees, and/or may receive other inducements, from Fundraising Companies in connection with the listing of Offers on the Platform,

16.1.2 a member of the Wahed Group may look to list an Offer on the Platform and we will then be required to review the Offering Materials of that Wahed Group member and provide their Offering Materials to Investors, or

16.1.3 we may inadvertently prioritise the interests of one Investor over another, for instance, where one Investor has purchased a significantly greater number of Investments than another Investor.

Further examples are set out in our Conflicts of Interest policy on our Webpage.

16.2 Under Applicable Law, we must have in place arrangements with a view to taking all reasonable steps to prevent conflicts of interest from adversely affecting the interests of our clients. Details of our Conflicts of Interest policy are available on the Platform.

16.3 If a conflict of interest arises, we shall not be obliged to disclose or take into account any information or other matter which comes to our notice or the notice of any Affiliate or any of the employees, directors, agents of us or any Affiliate:

16.3.1 where we reasonably believe that this would be a breach of any duty of confidentiality owed to such person, or

16.3.2 which does not come to the actual notice of the individual providing the Service in question.

16.4 We have a compliance department which is responsible for ensuring that our control structures and procedures are adequate to ensure compliance with Applicable Law. We are committed to operating in the best interests of WahedX's clients and managing conflicts of interest fairly. Where there is a conflict of interests, WahedX will not knowingly deal unless we have taken reasonable steps to ensure fair treatment for our clients.

17. YOUR DATA

17.1 With respect to the data submitted by you, you agree to:

17.1.1 update the registration and profile information and to keep it current and accurate,

17.1.2 post through the Platform only content that you own, have created, or which you have clear permission to publish, and

17.1.3 be responsible for the content you upload, post, email, transmit, or otherwise make available on or through the Platform.

17.2 You also acknowledge and agree that subject to Applicable Law:

17.2.1 we do not endorse any Investor’s content and are not responsible or liable for any such content, even though it may be unlawful, harassing, defamatory, privacy-invading, abusive, threatening, harmful, vulgar, obscene, or otherwise objectionable, or may infringe upon the intellectual property or other rights of another, and

17.2.2 we do not have an obligation to pre-screen any content. However, we have the right (but not the obligation) in our sole discretion to refuse, edit, move, or remove any content that is submitted on or through the Platform.

17.3 Further detail about how we handle your personal data in relation to the Services is set out in our privacy policy set out on our Platform.

18. SERIOUS CRIME AND FINANCIAL SANCTIONS

18.1 We have obligations under Applicable Law in relation to the prevention of serious crime and in relation to international sanctions.

18.2 As part of this, we are required to obtain and verify certain information concerning our clients and others with whom we have a business relationship. We are also required to make reports to agencies involved in the prevention, investigation, prosecution and enforcement of such measures.

18.3 You agree promptly to provide any information which we may require in relation to the matters set out in this Clause 18.

19. TERM AND TERMINATION (i.e. ending the Agreement)

19.1 The Platform Agreements will remain in force until either party terminates it (i.e. ends it) in accordance with this Clause 20.

19.2 You may terminate the Platform Agreements at any time by giving notice to us.

19.3 We may terminate or suspend the Platform Agreements by notice to you if:

19.3.1 you breach any provision of the Platform Agreements (including these Terms and Conditions) in any way which we would reasonably regard as material,

19.3.2 we reasonably consider that we are required to terminate the Platform Agreements under Applicable Law,

19.3.3 we suspect you have been involved in fraud, money laundering or other illegal activities,

19.3.4 we become aware that you are or have become a citizen or resident of any country or territory where we reasonably believe we cannot provide the Services (or where we do so may lead to significant detriment to us),

19.3.5 you use the Services in any of the following ways:

(a) in a way that causes, or is in our view likely to cause, the Services or access to them to be interrupted or damaged in any way,

(b) to send or reuse material which is illegal, offensive, abusive, indecent, obscene, defamatory or menacing,

(c) to send or reuse material in breach of copyright, trademark, confidence, privacy or other intellectual property right,

(d) which consists of or contains software, viruses, political campaigning, commercial solicitation chain letters, mass mailings or spam, or

(e) in a way which we consider may cause annoyance, inconvenience or needless anxiety to other users.

19.4 If we terminate the Platform Agreements, we may limit your access to the Platform in a way that we only accept selling instructions and/or transfer of the Investments and do not permit you to purchase further Investments or purchases. We will only exercise this power in accordance with Applicable Law.

19.5 Upon termination of this agreement for any reason, any Client Money held on your behalf under this Agreement will be transferred back to you, except for any amounts subject to an order to purchase an investment with a Fundraising Company that is irrevocable, as stipulated in Clause 6.8.7 and 6.9.7. The Client Money held on your behalf will be transferred to an account designated by you. You must provide us with the details of your designated account for the return of funds. If we do not have the details of a valid account for you at the time of termination, the Custodian will continue to hold your Client Money until you provide us with information of a valid account. Once we receive the appropriate account details from you, we will instruct the Custodian to transfer your Client Money to the designated account.

19.6 In the event that any Client Money is subject to an irrevocable order to purchase an investment in a Fundraising Company, as stipulated in Clause 6.8.7 and 6.9.7, at the time of termination of this agreement, such funds will be utilised to execute the investment purchase order in alignment with the terms and conditions of that order. The investments purchased will be treated in the same manner as all other Investments owned by you. If applicable, any remaining funds will be transferred back to you in the manner specified in Clause 19.5.

19.7 If, following termination, you have not submitted instructions in relation to your Investments within a reasonable time or by such time as specified by us, we may arrange for the sale of your Investments at the best price which, in our reasonable opinion, can be reasonably obtained at that time.

19.8 The funds from the sale of your Investments shall be transferred to the Custodian who will then arrange for the funds to be paid to your cash account known to us. In the event that we do not have the details of a valid cash account for you, these funds will be held by the Custodian until you send us information about your valid cash account.

19.9 You also agree that we can deduct from any Client Money and/or proceeds received, any sums which we reasonably consider to be due to us under the Platform Agreements and any reasonable expenses we may incur (including banking fees) in relation to termination.

19.10 In the event that your Investments cannot be sold in accordance with Clause 19.6, we shall instruct the Custodian to transfer the Investment to your physical custody or such other custodian as you may instruct us in writing, subject to any Applicable Law.

19.11 In the event of your death, we will comply with Applicable Law governing your estate. We will be authorised to act in accordance with any reasonable instructions given to us by your personal representatives or other trustees appointed under your Will, provided that they provide us with appropriate identifying material authorising them to act in this capacity. We will not, however, permit such persons to purchase further Investments and will only accept their instructions in relation to withdrawal of cash and sale of Investments.

20. AMENDMENTS (changing the Agreement)

20.1 We may change the terms of the Platform Agreements, including these Terms and Conditions, by notice to you or by posting the amended version on the Platform.

20.2 We will typically only make changes in the following circumstances:

20.2.1 to reflect Applicable Law, including significant changes in law or regulation which have been made or which we expect to happen,

20.2.2 to reflect changes in external market rates or currency rates,

20.2.3 to introduce new measures to protect us against fraud or financial crime,

20.2.4 to change our contact details,

20.2.5 to put right any obvious mistakes,

20.2.6 to reflect other legitimate cost increases or reductions associated with providing our Services to you,

20.2.7 where we reasonably believe that the changes would make the Platform Agreements easier to understand, fairer or more favourable to you,

20.2.8 to reflect what we believe to be overall improvements in how we provide the Services (including to accommodate new technology or systems which we introduce or to reflect changes in the banking, investment or financial system), and

20.2.9 to suspend, modify or withdraw any part of the Services where we have concluded in our discretion that it is no longer practical or economic to continue to provide it on the basis set out in the Platform Agreements.

20.3 We will give notice of changes by posting them on the Platform or by e-mail to you.

20.4 We will normally give you 14 days’ notice of any change except where we reasonably consider that it is beneficial to you or is required by Applicable Law. If you are unhappy with any changes to the Agreement, you may terminate the Agreement within the period of notice (after which you will be deemed to have accepted it).

21. EVENTS BEYOND OUR REASONABLE CONTROL

21.1 Neither we nor you will incur any liability whatsoever for any partial or non-performance of any obligations by reason of any Event beyond the Reasonable Control of the relevant party.

21.2 We will use reasonable efforts to mitigate the effect of any Event beyond our Reasonable Control.

22. LIABILITY

These Clauses on liability are important so you should read them carefully. Please also read the provisions on liability set out in Clause 7 carefully.

22.1 You will be liable to us for any loss or damage suffered by us as a directly foreseeable consequence of any material breach of the Platform Agreements by you or your negligence, wilful misconduct or fraud.

22.2 If you are not a Consumer, you will indemnify us for all costs, losses, expenses, claims or damages or charges which arise as a direct or indirect consequence of your use of the Platform.

22.3 We will not be liable for any loss or damage suffered by you as a result of the performance or non-performance of investments made through the Platform. We will only be liable to you for any loss or damage which arises as a directly foreseeable consequence of our material breach of the Platform Agreement or our negligence, wilful misconduct or fraud.

22.4 We will not be liable to you for any indirect, incidental, punitive or consequential damages, loss of business, loss of opportunity, loss of profits, loss or corruption of data, loss of goodwill or reputation caused by us in connection with the Platform Agreements.

22.5 Our liability to you for any loss or damage arising in connection with any specific Investment shall be limited to no more than the amount you invested (or in the case of any transaction on the Platform, the purchase price of any Investment).

22.6 Nothing in the Platform Agreements excludes or restricts our liability for death or personal injury, fraud or fraudulent misrepresentation or any liability to the extent that any such liability cannot be excluded or restricted under the Securities Commission regulations.

23. NOTICES

23.1 Unless we specify otherwise in any Additional Terms, any notice, request or other communication to be given or made by you to us shall be made electronically via the Platform or by sending an email to support.ventures@wahed.com during our standard Business Hours, which are from 9:00AM to 5:00 PM local time, Monday through Friday, excluding public holidays

23.2 Any notice, request or other communication received outside of Business Hours will be deemed to have been received on the next business day.

23.3 This does not apply to any formal notice of legal proceedings which must be given by post to the address specified at Clause 28 or such other address as we shall specify from time to time.

23.4 We may communicate with you either by electronic communication via the Platform, by e-mail or (where we consider it appropriate) by post or telephone during our Business Hours.

23.5 Communications by us to you shall be deemed to be received:

23.5.1 if sent by post to an address in Malaysia two Business Days after posting (or five Business Days if sent to an address outside Malaysia), or

23.5.2 if sent by e-mail or electronic communication, immediately on sending provided that we do not receive notice of non-transmission or non-receipt.

24. COMPLAINTS AND COMPENSATION

24.1 If you are dissatisfied with any aspect of our Services or the Platform, you can send a formal complaint to support.ventures@wahed.com.

24.2 Your complaint will be handled in accordance with the Securities Commission regulations and our Complaints Handling Policy, which is available on our Platform.

25. IMPORTANT LEGAL PROVISIONS

25.1 If any provision of the Platform Agreements becomes invalid or unenforceable, the provision will be treated as if it were not in the Platform Agreements and the remaining provisions will still be valid and enforceable.

25.2 All disclaimers and exclusions in the Platform Agreements shall survive termination.

25.3 Our failure to insist on you strictly complying with any provision of the Platform Agreements or any or omission on our part will not amount to a waiver unless expressly stated in writing that it is a waiver and setting out the provision which it is intended to waive.

25.4 These Terms and Conditions, and the other Platform Agreements, are supplied in English.

25.5 Nothing in the Platform Agreements is intended to confer any benefit on any person who is not a party to the Agreement and no third party shall have any rights to enforce any of its terms.

25.6 Nothing in the Platform Agreement is intended to, or will be deemed to, create any partnership or joint venture between any of you, user the Custodian.

26. ASSIGNMENT, TRANSFER AND DELEGATION

26.1 The provisions of the Platform Agreements are personal to you and you shall not assign or transfer any of your rights or obligations under them.

26.2 Subject to Applicable Law, we may delegate our functions and responsibilities under the Platform Agreements. Except where otherwise stated, we will remain responsible to you for the performance of that function or responsibility.

26.3 We may assign or transfer our rights and obligations under the Platform Agreements to an appropriately regulated person on 30 days’ notice to you.

27. APPLICABLE LAW AND DISPUTE RESOLUTION

27.1 All disputes arising out of or relating to the Platform Agreements shall be subject to the exclusive jurisdiction of the Malaysia courts.

27.2 The Platform Agreements shall be governed and construed in accordance with the law of Malaysia shall govern any communications between us including any communication, discussion or negotiation before entry into the Platform Agreements.

28. Wahed X Sdn. Bhd.

28.1 Wahed X Sdn. Bhd. is a company incorporated in Malaysia with company number (202301007193 (1501114 - X) , whose registered office is 22 - 1, Jalan 1/128, Happy Garden, Off Jalan Kuchai Lama 58200, Kuala Lumpur, WP Kuala Lumpur, a firm authorised and regulated by the Securities Commission Malaysia.

Contact details:

E-mail: support.ventures@wahed.com

Post Level 1, Centre North-East Wing, Sapura @Mines, Seri Kembangan, 43300, Selangor.

SCHEDULE 1: DEFINITIONS AND INTERPRETATION

1. The following capitalised terms when used in the Agreement shall have the following meanings:

Additional Terms – Any further terms and conditions specific to a particular Investment to which an Investor agrees.

Affiliate - An undertaking in the same Group as WahedX.

Applicable Law - Any law, statute, ordinance, rule, regulation, order or determination of any governmental or regulatory authority or any requirement of any official body (including any taxation authority) which is binding on us, including the CMSA and the Securities Commission regulations.

Business Day - Any day which is not a weekend or a public holiday in Malaysia.

Angel Investor – Has the meaning given to it in the ‘Guidelines on Recognised Markets.’

Sophisticated Investor – Has the meaning given to it in the ‘Guidelines on Recognised Markets.’

Client Money – Money held by the Custodian for or on behalf of Investors in connection with the Services. This includes not only the principal amounts deposited by the Investors for the purpose of making Investments via the Platform but also any dividends, returns on investments, or distributions received as a result of such Investments.

Cooling-off Period - Means a specified duration of six (6) business days commencing from the day of placement of an order towards an Offering and ends at the close of business on the sixth business day following the placement. During this period, you have the right to withdraw the full amount of your funds from the offering.

Consumer - Any natural person using the Platform and the Services for purposes outside their trade, business or profession.

Custodian – AmanahRaya Trustees Berhad, a company incorporated in Malaysia with company number (200701008892 (766894-T)).

Trust Deed – The agreement between us and the Custodian in relation to the holding of Client Money and the safeguarding and administration of Investments, as amended from time to time.

Custodied Fundraising Company – A Fundraising Company, the Investments in respect of which will be held by the Custodian , and safeguarded and administered by the Custodian, in accordance with Clause 8.

Direct Investment Fundraising Company – A Fundraising Company, the Investments in respect of which will be held directly by an Investor.

Dissolution Event – Has the meaning set out in Clause 13.1.4 above.

Event – Means one of those events, acts or circumstances set out in Clause 13.1 above.

Events Beyond a party’s Reasonable Control - Includes any acts of God, war, revolution, civil disorder, terrorist attack, strikes or industrial disputes, acts or regulations of any government or regulatory or supranational bodies or authorities (including the repeal or amendment of any current Applicable Law), epidemic or pandemic, breakdown, failure or malfunction of any communications or computer service.

Securities Commission regulations- The Handbook of rules and guidance of the SC. When we refer to the SC and the Securities Commision regulations , we also mean any regulator which may replace the SC and the rules it may make to regulate our business.

CMSA- the Capital Markets and Services Act 2007.

Fundraising Company - A business or undertaking seeking investment via the Platform. This can include both companies or other body corporates.

Guidelines - means the ‘Guidelines on Recognised Markets’ issued by the Securities Commission Malaysia and any subsequent thereto.

Insolvency Event – Any of the following:

(a) entering into a composition or arrangement with, or convening a meeting of, creditors,

(b) the appointment of a receiver, administrative receiver or a liquidator,

(c) the making of an order or a resolution for administration or winding-up,

(d) ceasing or threatening to cease to carry on business or suspending or threatening to suspend payment of any of its debts or being deemed by law to be unable to pay debts,

(e) making a voluntary arrangement or composition with or for the benefit of creditors, or

(f) allowing, permitting or doing anything analogous to any of the events in (a) - (e) under applicable law.

Issuer – Any business or undertaking which has sought investment via the Platform and in which you have made an Investment. This can include both companies or other bodies corporates.

Investor - A person who has registered to use the Platform as an Investor.

Investment Period – The period in which you hold, or the Custodian holds on your behalf, a specific Investment made via the Platform.

Investments – The Securities issued by an Issuer to either you or the Custodian in consideration for the capital you have invested via the Platform.

Material Adverse Change - may include any of the following: (a) The discovery of a false or misleading statement in any disclosures in relation to the offer; (b) The discovery of a material omission of information required to be disclosed in relation to the offer; or (c) There is a material change or development in the circumstances relating to the offering or the issue.

Nominee – AmanahRaya Trustees Berhad, a company incorporated in Malaysia with company number (200701008892 (766894-T)).

Offer - The seeking of investment funds by a Fundraising Company.

Offer Period – The time within which an Investor must send an order to invest in respect of a particular Investment to us.

Offering Materials - Information posted to the Platform in relation to an Offer and which is made available to Investors.

Platform - The online and app-based investment platform provided by us.

Platform Agreements – The agreements governing the relationship between you and us, as set out in Clause 3.1 above.

Risk Warning Notice – The risk warning notice on the Platform which sets out some of the risks involved in purchasing Investments.

Securities - means the shares, certificates, warrants/options or rights to any of the aforementioned, issued by the Fundraising Company, and other securities that may be used from time to time representing the Investment.

Security Details - Any username and password necessary for you to access the Platform.

Services - The services we provide via the Platform as set out in more detail in Clause 6 of the Agreement.

Target – The amount of money which a Fundraising Company seeks to raise by the issue of Investments to Investors.

Wahed Group - A group of entities belonging to the same Group as WahedX and being direct or indirect subsidiaries of Wahed Inc.

WahedX, Wahed Ventures, we or us – Wahed X Sdn. Bhd..

Account - The facility on the Platform to view Investments and money held.

You – You, our client, the Investor.

2. In these Terms and Conditions, unless a contrary intention appears:

2.1 use of the singular shall include the plural and vice versa;

2.2 use of any gender or neuter includes the other genders;

2.3 headings are used for reference only;

2.4 references to any legislation or all include any successor legislation or rule, and are to Malaysian legislation or rules unless expressed otherwise;

2.5 a time-of-day shall be construed as a reference to Malaysian time; and

2.6 any phrase introduced by the terms ‘including, ‘include’, ‘in particular ‘or any similar expression is to be construed as illustrative and does not limit the sense of the words preceding those terms.

Schedule 2: Fees and charges